Contact: +91 99725 24322 |

Menu

Menu

Quick summary: Explore the ins and outs of carbon offset markets in our latest blog. Learn how these markets function, their significance in combating climate change, and how you can participate in building a more sustainable future through carbon offsets.

Understanding Carbon Offset markets is crucial in the context of addressing climate change and achieving sustainability goals. These markets have emerged as a key tool for organizations and governments to take tangible steps towards reducing their carbon footprint.

According to Markets & Markets, the global carbon offset/ carbon credit market in terms of revenue was estimated to be worth $414.8 billion in 2023 and is poised to reach $1602.7 billion by 2028, growing at a CAGR of 31% from 2023 to 2028

In this blog, we will delve into the intricacies of carbon offset markets, exploring how they work, their significance in the fight against climate change and the various types of projects that contribute to these markets.

Carbon Offset markets also known as Emissions Trading or Carbon Trading markets are integral components of global efforts to mitigate climate change and reduce greenhouse gas emissions. These markets operate on the principle that businesses, industries or individuals can compensate for their own emissions by investing in projects that reduce or remove an equivalent amount of emissions from the atmosphere.

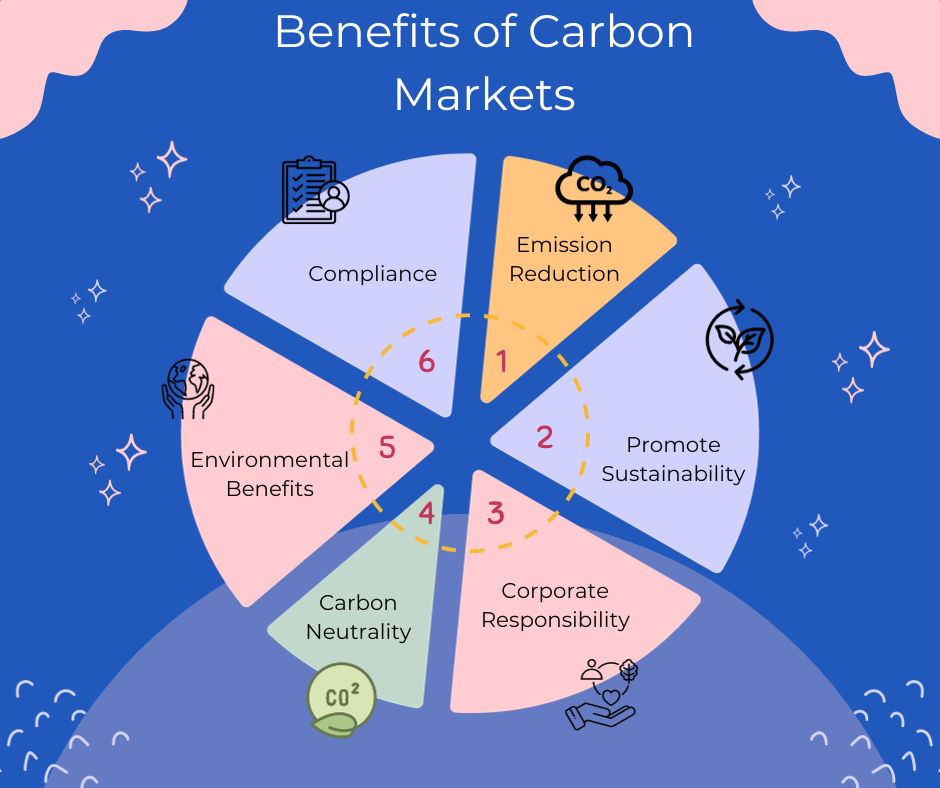

Carbon Offset markets play a important role in the global effort to combat climate change and reduce greenhouse gas emissions. They serve critical functions in the broader sustainability landscape.

Carbon offset markets facilitate reduction of GHG emissions. They provide a mechanism for entities to compensate for their own emissions by investing in projects that reduce or remove an equivalent number of emissions from the atmosphere.

Carbon offset markets create economic incentives for adopting sustainable practices and transitioning to cleaner technologies. By putting a price on carbon emissions, these markets encourage industries to seek more energy efficient, low carbon and environmentally friendly alternatives.

A significant portion of carbon offset projects involve renewable energy sources such as wind, solar and hydropower. These projects receive funding through offset purchases, which promotes growth of clean energy infrastructure and reduces reliance on fossil fuels.

Many offset projects focus on preserving and restoring ecosystems like forests, wetlands and mangroves. This not only sequesters carbon but also protects biodiversity, supports wildlife habitats and enhances resilience of ecosystems to climate change impacts.

Carbon Offset markets are instrumental in the transition to a low carbon economy. They facilitate the financing of projects that may not have been feasible otherwise, accelerating the shift away from carbon intensive industries.

Carbon offset markets help organizations meet regulatory requirements in regions with carbon pricing mechanism and emission reduction targets.

Businesses that participate in carbon offset programs demonstrate a commitment to environmental responsibility. It allows consumers to make choices that align with their values and enhances a company’s reputation by showcasing its dedication to sustainability.

Carbon offset markets are built around emission reduction projects that are carefully designed to lower or capture GHG emissions. These projects can take various forms including reforestation and afforestation, renewable energy, methane capture at landfills and more.

Carbon credits also known as carbon offsets represent a quantified reduction or removal of GHG emissions. These credits are tradeable commodities with each one typically equivalent to one metric tonne of Co2. They serve as means for entities to offset or neutralize their own emissions by purchasing offsets generated by emission reduction projects. Carbon offsets are verified, certified and tracked to ensure their legitimacy and effectiveness.

In some regions, carbon offset markets are integrated into broader cap and trade systems. These systems set an overall cap on emissions within a jurisdiction and allocate allowances or permits to entities for a specific level of emissions. Entities that reduce emissions below their allocated allowance can sell excess allowances as carbon offsets, while those exceeding their limits must purchase additional allowances or offsets to comply with regulations.

Carbon offset markets can be categorized as voluntary or compliance markets. Voluntary markets are driven by entities voluntarily choosing to offset their emissions for environmental or corporate responsibility reasons. Compliance markets on the other hand are established by governments and regulatory bodies to enforce emission reduction targets and requirements set by law.

Carbon offset markets establish a price for carbon emissions, encouraging businesses to internalize the environmental cost of their activities. This pricing mechanism creates economic incentives for adopting cleaner technologies and sustainable practices.

These are created as a result of any national, regional or international policy or regulatory requirement. These are marketplaces through which regulated entities obtain and surrender emissions permits or offsets in order to meet the predetermined regulatory targets. In the cap-and-trade programs, there are emitters and intermediaries that trade allowances to make profit or to meet regulatory requirements. The active compliance carbon offset programs is the United Nations Clean Development Mechanism (CDM), source of offsets for Kyoto protocol Signatory countries.

The voluntary carbon market encompasses all transactions of carbon offsets that are purchased without the intention to surrender it into an active regulated carbon market. It includes offsets that are purchased with the intent to resell or retire to meet carbon neutral or other environmental claims. They are mainly driven by companies that take responsibility for offsetting their own emissions. The current supply of voluntary carbon credits comes from private entities which develop carbon projects, governments that develop programs certified by carbon standards which generate emission reductions or removals. The demand is usually from individuals who want to reduce their carbon footprint or corporates who want to achieve their sustainability targets and other players who want to trade these credits at a higher price to make profits.

Governments and Regulatory bodies play a crucial role in shaping and overseeing carbon offset markets. They create the legal and regulatory frameworks that govern carbon trading and offset activities. These entities establish emission reduction targets, set standards for offset projects and enforce compliance with carbon reduction regulations. The European Union Emissions Trading System ( EU ETS) is one of the world’s largest emission trading schemes regulated by the European commission.

Corporations with high emissions participate in carbon offset markets to meet emission reduction targets. They often engage in emissions trading schemes, buying and selling carbon credits. These entities set internal carbon reduction goals, purchase carbon offsets to compensate for their emissions and actively engage in trading to optimize their carbon portfolios. Companies like Microsoft have committed to becoming carbon negative by 2030 and they invest in offset projects to achieve this goal.

Carbon Offset Project developers are instrumental in creating and managing projects that generate carbon offsets. These projects can include reforestation, regenerative agriculture, methane capture and renewable energy. Project developers identify, design and implement offset projects. They are responsible for ensuring these projects adhere to established standards and generate verifiable carbon credits. Nature Conservancy is a prominent organization that develops carbon offset projects such as forest conservation and restoration efforts to mitigate climate change.

For Buyers

For Sellers

Carbon markets can foster innovation, collaboration and transparency in the fight against climate change.

The challenges in carbon offset markets are multifaceted, spanning various aspects of market dynamics, environmental concerns and regulatory issues.

Carbon offset markets can be highly volatile with the value of offsets fluctuating based on factors like government policies, market demand and geopolitical events.

Ensuring the credibility of carbon offset projects is crucial. Verifying that emission reductions are real and additional can be complex and costly. The risk of greenwashing remains.

There is no universal standard for carbon offsets, leading to a proliferation of different offset types and methodologies. This lack of standardization can make it difficult for buyers to compare and choose offsets that align with their sustainability goals.

Demonstrating that emission reductions or removals are additional to what would have occurred without the offset project can be challenging. Without additionality, offset projects may not effectively contribute to climate change mitigation.

Carbon offset projects can face risks like natural disasters or land-use changes that could reverse the emissions reduction achieved.

Carbon offset projects can displace local communities. Balancing environmental benefits with social and equity considerations is a challenge.

Changes in government policies and regulations can have impact on the carbon offset market. This can affect investment decisions.

The process of identifying, purchasing and retiring carbon offsets can involve high transaction costs.

Avoiding double counting is essential for integrity of offset markets.

Scaling up offset supply, while maintaining quality is a major challenge, amid the growing demand of meeting global emission reduction targets.

Technology solutions can play a significant role in addressing the challenges faced by carbon offset markets.

Technology driven approaches:

Blockchain technology can provide a transparent and immutable ledger for tracking carbon offset transactions. It ensures traceability of offsets from origin to retirement, reducing the risk of double counting and improving credibility of offset projects.

IoT devices and sensors can be deployed in offset projects to continuously monitor emissions reductions. Real-time data can be securely recorded on blockchain, making it easier to verify the environmental impact of projects.

AI algorithms can analyze historical data and project specific information to assess the additionality of carbon offset projects. This helps to identify projects that genuinely contribute to emissions reduction.

Satellites equipped with remote sensing technology can monitor changes in land use and forest cover in offset project areas. This helps ensure permanence of emissions reductions.

Technology platforms facilitate standardization of carbon offset methodologies and reporting. They provide guidelines and calculators to streamline the development and validation of offset projects.

Online marketplaces powered by technology allows buyers and sellers to trade carbon credits efficiently. These platforms provide a centralized hub for offset transactions, reducing costs.

Trace Carbon, TraceX Sustainability and carbon management solutions contribute to the carbon offset markets by fostering transparency, accuracy and trust. By streamlining project verification and data collection, TraceX helps make carbon offset projects more accessible and attractive to project developers. This in turn accelerates the adoption of carbon offset initiatives and supports global efforts to combat climate change.

In conclusion, understanding carbon offset markets is essential for businesses and governments aiming to take meaningful steps towards mitigating climate change. These markets offer a crucial mechanism for investing in emission reduction projects and achieving carbon neutrality.

By purchasing carbon credits, stakeholders can support initiatives that reduce greenhouse gas emissions, promote sustainable practices and contribute to a more environmentally responsible future. As the world intensifies its focus on combating climate change, the role of carbon offset markets becomes very important, making it imperative for everyone to grasp their significance and actively participate in creating a more sustainable and resilient world.