Contact: +91 99725 24322 |

Menu

Menu

Quick summary: Explore the path to discovering high-quality carbon credits for the carbon market. Learn how TraceX's DMRV solutions empower organizations to generate authentic and impactful credits through accurate measurement, transparent reporting, and rigorous verification. Join us in shaping a greener future and making a meaningful impact on the global fight against climate change.

In the rapidly evolving landscape of carbon markets, the quest for high- quality carbon credits has taken the centre stage. As the world intensifies its efforts to combat climate change, discerning organizations are seeking not just any carbon credits, but those with exceptional quality that generates genuine environmental impact.

According to the Taskforce on Scaling Voluntary Carbon Markets, the voluntary carbon market could potentially scale to a value of $50 billion annually by 2030, further emphasizing the significance of high-quality carbon credits.

The global economy must reach net-zero carbon dioxide emissions by 2050 and we must cut emissions by half within the next decade to be on track. Companies around the world have agreed to limit global warming to 1.5˚C and this calls for massive reduction in GHG emission reductions. Businesses are taking drastic measures to decarbonize their emissions. However, this is not enough and hence it is necessary to reduce or remove the emissions with carbon offsetting strategies.

Do you know that till now, 2,5 trillion tons of carbon equivalents have been released into the atmosphere and we still continue to release 50 billion tons of CO2e each year?

This has spurned the advent of Voluntary Carbon Markets. In order to satisfy the demands for carbon credits to reduce GHG emissions, there is a need for carbon markets that are transparent, verifiable and robust. Let us look deeper into the criteria required to bring integrity into the carbon markets.

The unprecedented demand for carbon credits has catapulted the Voluntary carbon market. The researchers at Bloomberg are predicting that carbon offset prices will increase fifty-fold by 2050.

Nature-based solutions play a critical role in an organization’s net-zero strategies. After a company has taken the necessary steps to reduce their emissions, as a part of the abatement strategy, they can neutralize their emissions with carbon credits. Carbon credits are tradable instruments certifying that one equivalent ton of CO2e has been avoided, reduced or removed from the atmosphere. They are normally issued by certifying organizations, known as third party standards. These standards follow scientific methodologies to validate the removal and avoidance of carbon offset projects. These projects are highly varied and can be classified according to their type of actions.

Emission removal through

Emission avoidance and reduction through

The sudden onslaught of carbon credits options in the marketplace has overwhelmed buyers with questions and concerns regarding the quality and credibility of theses carbon credits. There are several questions that need to be answered.

Are the measurements and estimates of these carbon credits authentic?

Are these offsetting projects really generating additional benefits?

Is the company taking any risk in partnering with these carbon projects?

What is the environmental integrity of these credits?

With the evolving standardization in frameworks, in order to realize effective carbon markets, there is a need for diligent efforts from all stakeholders, particularly buyers and project developers to align on high quality standards. This should reduce the risk for buyers and benefit the people and planet.

A high-quality carbon credit accurately represents GHG emission reductions or removals achieved through carbon offsetting project activities. These activities need to maximize climate, socio-economic and ecological benefits for the communities and the planet. Well informed decisions during project design and development and following the prescribed methodologies and standards according to Carbon standards along with regulatory compliance helps to realize high quality carbon credits in the voluntary carbon market.

High quality carbon credits represent the real and additional GHG emission reductions or removals which are quantified based on the calculations of baselines, additionality, leakage and permanence. The emissions should be quantified using credible baselines and discount for the uncertainty in leakage. The measurement of emission reductions requires a robust Monitoring, Reporting and Verification (MRV)

systems. The projects should follow the methods consistent with IPCC for quantification and should use new monitoring technologies wherever possible.

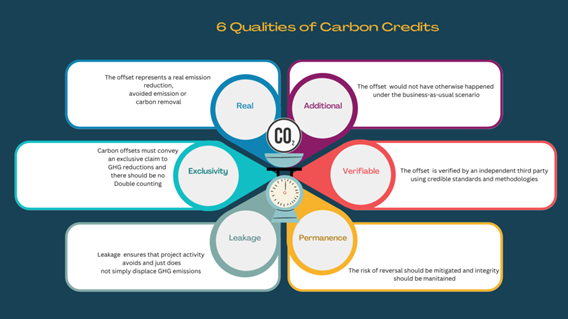

The six qualities that need to be considered for a carbon credit are:

The measure of emission reductions must be based on robust methods with a rigorous MRV system. The measurements must avoid over and under estimation of carbon levels. Every project must calculate how many tonnes of carbon it will sequester or avoid, and any errors can lead to overestimation that could lead to void credits. The methodologies and accounting mechanisms ensure that every credit correspond to one physical tonne of carbon dioxide removed or reduced.

The real time impacts generated by a farm over time can be set using baselines and tracking changes accordingly. Important metrics for climate assessment like soil carbon and fertilizer use can be assessed and monitored throughout the project lifespan. Recoding historical data before the project began with regular reporting of farm data throughout the process makes the data verifiable.

Additionality means that the GHG reductions and removals associated with a carbon credit would not have taken place without the resources provided by the project. They demonstrate that the associated emission reductions or removals would not have occurred in the absence of the offset project.

Additionality could be financial, technological, social and ecological and this could be difficult to determine as it is difficult to determine if these changes would have changed in a without project scenario. Emission reductions or removals cannot be due to activities that are already legally required or are in common practice in that area.

Evaluating additionality is complicated. In a forestry project, there could be questions like would there be a forest without a carbon credit or can forest cover loss be stopped by the financial incentive of carbon credits

Additionality can be credibly demonstrated at large spatial scales by showing that emission reductions and removals are below the level of historical trends. Developing farm practice plans with sustainability practices can increase farm profitability and generate carbon benefits.

Permanence ensures that each carbon credit generated represents a long-term climate benefit which is often 100 years. Projects must mitigate the risks that these GHG emission reductions or removals are reversed at some point in the future. This could be due to natural disasters, human activities or climate change. Permanence is relevant for credits that represent carbon removals through nature-based offsets. For example, forestry projects are vulnerable to forest fires and logging that releases the sequestered carbon back into the atmosphere.

The risk is often managed through buffer pools. Projects set aside a portion of their credits in a buffer pool from which credits are subtracted from the pool to compensate when reversals happen.

Leakage ensures that a project activity avoids and just does not simply displace GHG emissions. Carbon leakage occurs when a farm causes an increase in GHG emissions outside the project boundary. Leakage occurs at all levels of implementation, and it occurs when a project causes the drivers of these emissions to move rather than stop emitting.

Leakage can be prevented by managing, quantifying and accounting for and compensating these shifts with best practices across projects.

Verification determines if an emissions reduction and carbon sequestration has truly taken place as certified by third party organizations. Verification ensures that the data from the farm accurately assesses whether the changes have occurred.

High quality carbon offsets are certified and verified by reputable offset standards to ensure their authenticity. The different standards like the CDM, Gold standard and the Verra provide oversight of the offset project and its GHG reductions.

Carbon offset credits must convey an exclusive claim to GHG reductions. If two companies are claiming the same reduction, they are “Double Counting”.

Similar to the overestimate of emissions, this would result in credits being purchased that has no positive effect on mitigating climate change. This can occur in three ways. Double issuance occurs if two different parties count the same offset credit towards their GHG reduction claim, if more than one offset credit is issued for same GHG reduction and if offset credits are issued to a project but another entity counts the same reductions for its own GHG reduction goal.

Incorporating the GHG accounting principles into the development and issuance of carbon credits helps to establish a strong foundation for their credibility and effectiveness.

Carbon offset projects need to be more than transactional interactions between project developers, communities and buyers. It should ignite more engagement among the stakeholders for a greater impact. Promoting knowledge co-creation and development, continual education and guidance together with access to carbon markets fosters deeper engagement with the on-ground stakeholders thereby providing companies greater confidence in the project’s values and avoiding greenwashing.

High quality projects must be designed and monitored in alignment with carbon standard requirements and relevant policies. They need to provide benefits to local communities, preserve ecosystems and should not cause social and environmental harm.

Recently the ICVM published the much-anticipated Core Carbon Principles. The Core Carbon Principles (CCPs) are a global benchmark for high-integrity carbon credits that set rigorous thresholds on disclosure and sustainable development. Developed with input from hundreds of organizations throughout the voluntary carbon market, the CCPs provide a credible and rigorous means of identifying high-integrity carbon credits that create real, verifiable climate impact, based on the latest science and best practice.

Explore how ICVCM is shaping the voluntary carbon market for a sustainable future.

Technology solutions can revolutionize the generation of quality carbon credits by enhancing transparency, accuracy, and efficiency throughout the entire process. Here’s how:

Data Accuracy: Technology solutions enable precise measurement and monitoring of carbon emissions and removals. Advanced sensors, satellite imagery, and IoT devices provide real-time data, ensuring accurate quantification of carbon reductions or sequestration.

Transparency: Blockchain technology can create immutable records of carbon transactions, enhancing transparency and trust. This ensures that carbon credits are accurately verified and reliably traceable back to their source, reducing the risk of fraud or double counting.

Automated Verification: Machine learning algorithms and AI-powered analytics can automate the verification process, reducing the time and resources required for manual audits. This streamlines the verification process while maintaining rigorous quality standards.

Project Monitoring: Technology solutions allow for continuous monitoring of carbon projects, enabling project developers to identify issues promptly and take corrective actions. This proactive approach ensures that projects remain compliant with established standards and criteria.

Streamlined Documentation: Digital platforms and data management systems simplify the documentation process, enabling project developers to efficiently compile and submit required documentation for carbon certification. This reduces administrative burdens and speeds up the issuance of carbon credits.

Scalability: Technology solutions enable scalability by facilitating the management of large and complex carbon projects. Cloud-based platforms and scalable architectures accommodate the growing demand for carbon credits, supporting the expansion of carbon markets globally.

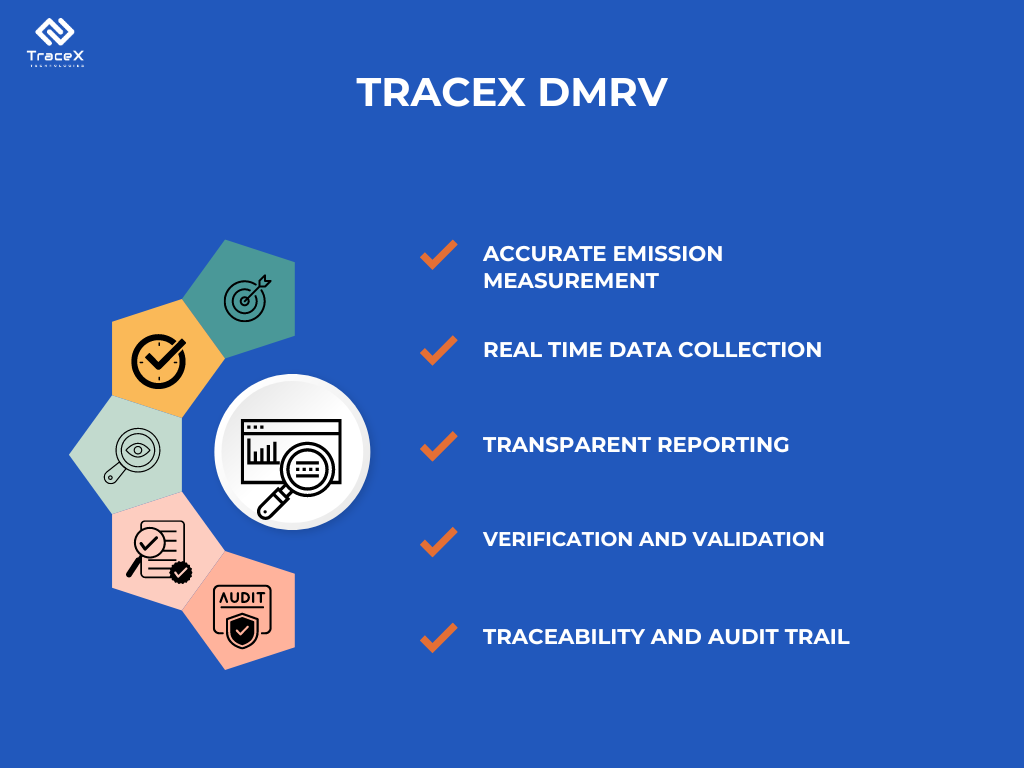

TraceX’s Digital MRV (Monitoring, Reporting, and Verification) systems leverage advanced technologies such as blockchain to facilitate the generation of high-quality carbon credits. Through automated data collection, real-time monitoring, and streamlined reporting processes, TraceX ensures accuracy and reliability in carbon credit generation. Its verification mechanisms guarantee the integrity of data, providing transparency and credibility to the entire process. By enhancing data accuracy and compliance with carbon credit standards, TraceX empowers organizations to produce carbon credits of the highest quality, contributing to environmental sustainability and meeting regulatory requirements effectively.

The carbon credit value chain is made up of developers, entrepreneurs, certifiers, technology service providers, distributors, auditors and other players. All the stakeholders need to take a collaborative approach and bring in a system of shared values to realize quality carbon credits. Integrity is vital to increase credibility and avoid greenwashing. The lack of clarity, inconsistent methodologies and lack of common standards are few of the challenges that needs to be addressed along with the above 6 qualities.

Carbon credits are an essential part of the business toolkit and the quality, characteristics and the unit cost of carbon credits should match the business needs.

The pursuit of high-quality credits is paramount in the evolving carbon markets. These credits not only signify a commitment to environmental stewardship but also reflect an organization’s dedication to a sustainable and carbon neutral future. By ensuring accurate measurement, transparent reporting and rigorous verification, you can confidently generate credits that stand out for their authenticity and effectiveness.