Contact: +91 99725 24322 |

Menu

Menu

Quick summary: Confused about EUDR-relevant HSN codes? Misclassification can cost you the EU market. Learn how to correctly tag commodities like coffee, rubber, and palm oil under EUDR and ensure seamless compliance.

Imagine spending months preparing a shipment for your European buyer—only to have it flagged at customs because your product was classified under the wrong code. Sounds frustrating, right? Unfortunately, this is becoming a real risk with the new EU Deforestation Regulation (EUDR). One of the most overlooked yet critical components of EUDR compliance is correctly identifying the EUDR-Relevant HSN Codes for your products.

Many exporters, producers, and even traders in coffee, cocoa, rubber, timber, and soy sectors are scrambling to figure out: “Are my products covered under EUDR? Which HSN codes trigger compliance?” The truth is—getting this wrong could mean delays, financial penalties, or even rejected shipments at EU ports. In this guide, we break down exactly which HSN codes fall under EUDR scrutiny and how to make sure your supply chain is classification-ready for risk-free exports.

Key Takeaways

Let’s be honest—nobody enjoys talking about codes and classifications. But when it comes to EUDR compliance HSN, ignoring these details could quietly sabotage your entire export plan.

Picture this: you’re a coffee exporter in Ethiopia or a rubber processor in Southeast Asia. You’ve done everything right—traceability mapped, geolocation verified, due diligence statement ready. But when your shipment arrives at an EU port, customs officials flag it. Why? Because the HSN code on your documents doesn’t match the EUDR-listed product codes.

Suddenly, your entire shipment is stuck. Your buyer is breathing down your neck. Every hour means storage fees piling up, delivery deadlines missed, and reputational damage that could cost you that contract—and maybe future ones.

Many exporters assume their product is safe because it’s a finished good—like roasted coffee or rubber-based industrial goods. But EUDR ties compliance to specific HSN codes, not just raw commodities. If your product falls “within scope” due to its code, you’re expected to prove it’s deforestation-free—period.

A tire manufacturer can misclassify imported rubber under a generic HSN code. EU customs can flag it, leading to delays and hefty penalties. All because the wrong code triggered non-compliance under EUDR.

Getting your HSN codes wrong isn’t just a paperwork issue—it’s a financial and market risk. And with the EU doubling down on traceability, geolocation, and legality checks, the stakes have never been higher.

So, ask yourself: Are you 100% sure your product’s HSN code is correct? Have you mapped which codes trigger EUDR compliance? Can you back your classification with documentation if challenged?

If you’re unsure—even slightly—it’s time to recheck. Because in this game, wrong codes mean lost markets.

For exporters, processors, and supply chain teams wondering—”Are we even looking at the right codes?

Let’s face it—HSN codes are often the most overlooked line in your export paperwork. They sit there, seemingly harmless, just a string of numbers you copy-paste from last season’s form. But under the EU Deforestation Regulation (EUDR), those numbers? They decide your fate at the border.

If you’re in rubber, coffee, cocoa, palm oil, soy, wood, or beef, your product likely falls into one of the “high-risk” HSN codes the EU has flagged. And here’s the hard truth—if you get that number wrong or fail to realize your product is tagged under EUDR, you’re looking at delays, rejected shipments, or worse—losing your buyer.

Picture a rubber processor shipping industrial-grade rubber sheet (HS 4008). The team assumed tires (HS 4011) were the only product to worry about. Wrong. EUDR covers specific rubber codes, including sheets, strips, and plates. That one wrong assumption cost them an entire container’s clearance.

Your HSN code isn’t just for classification anymore—it’s the trigger that tells EU customs whether your product must be backed by:

Miss the right code? You miss compliance. Period.

Only products that are listed in Annex I and made of or containing a commodity listed in Annex I are subject to the Regulation.

It’s no longer enough to know what you’re shipping—you need to know what code it’s shipping under and whether that code lands you in EUDR’s compliance net. Getting it wrong means your “high-value container” could turn into stranded inventory.

Ask yourself

If you hesitated, it’s time to double-check. Because EUDR isn’t just a regulation—it’s the new price of doing business in Europe.

Imagine this: You’re an exporter shipping a bulk container of cocoa beans or natural rubber to the EU. Everything’s packed, documents are ready—or so you think. But when your shipment hits customs, an official stops you and asks:

“Can you show me the correct HSN code and the Due Diligence Statement for this lot?”

This is the moment many exporters aren’t fully prepared for.

Under the EUDR (EU Deforestation Regulation), HSN codes aren’t just technical classifications anymore—they’re your product’s passport into the EU market. Every shipment of coffee, cocoa, rubber, timber, soy, palm oil, or beef must align with specific HSN codes listed under the regulation.

Example

A Vietnamese rubber processor ships industrial rubber (HS 4008) to a German tyre importer. Due to a coding oversight, the product is incorrectly declared under HS 4011 (tyres). Customs red flags the discrepancy. Why? Because the DDS submitted covers HS 4008, not 4011.

Outcome? Weeks of delay, legal fees, and possible rejection.

Under EUDR, authorities track and verify your product’s journey back to the farm. HSN codes are essential to:

➡ Example:

This ensures traceability from farm to port to buyer.

Attach GPS coordinates or farm polygon maps to the HSN-coded batch. This forms the core of your EUDR traceability proof.

If you’re exporting cocoa beans under HS 1801, the geolocation data must prove they came from a non-deforested farm post-Dec 31, 2020.

Manual tagging = errors.

Run a checklist before shipping:

Customs declarations have always been a paperwork nightmare. But with the EU Deforestation Regulation (EUDR) now in play, those export forms just got a whole lot more serious.

Gone are the days when simply listing your product’s name and quantity was enough. Now, getting your HSN codes right is mission-critical — because customs officials aren’t just checking your paperwork; they’re checking if your product is deforestation-free, traceable, and EUDR-compliant.

You now need to:

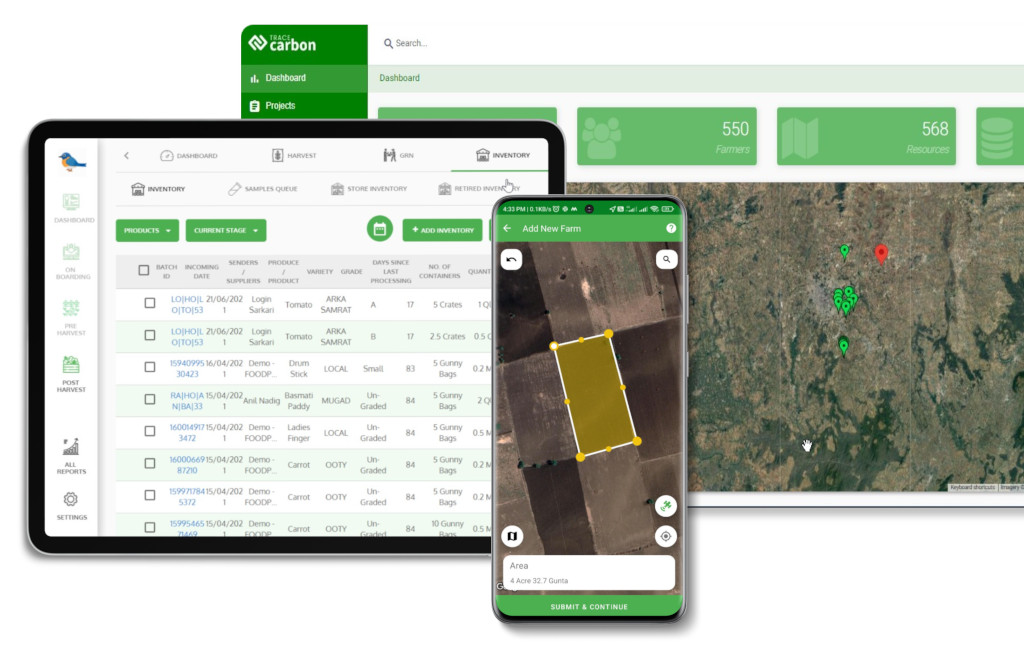

Platforms like TraceX make this seamless — from batch-level HSN tagging to auto-generated customs declarations ready for the EU’s systems.

TraceX’s EUDR Compliance Platform helps businesses seamlessly manage HSN code requirements by automatically tagging commodities like coffee, rubber, cocoa, and palm oil with their correct HSN classifications throughout the supply chain. This ensures that the right HSN codes are linked to each batch, shipment, and Due Diligence Statement (DDS)—reducing the risk of customs misclassification or compliance errors. The platform streamlines data capture from suppliers, validates traceability against the correct product codes, and generates EUDR-ready documentation aligned with customs expectations. For exporters and importers, this means smoother customs declarations, fewer costly errors, and full confidence during audits or EU market entry.

Navigating EUDR-relevant HSN codes isn’t just about regulatory compliance—it’s about securing seamless trade, avoiding costly delays, and ensuring your products continue to access the EU market. Misclassification or incomplete documentation can result in shipment rejections, financial penalties, and reputational risks. By aligning your supply chain with the correct HSN codes and integrating due diligence processes, you ensure full traceability and compliance readiness. Don’t leave it to chance—take control of your EUDR compliance strategy today.

HSN codes classify goods for international trade. Under EUDR, the correct classification ensures your products are subject to the right due diligence requirements and customs declarations, preventing shipment rejections.

Incorrect HSN codes can lead to customs holds, rejected shipments, fines, and even loss of market access. Ensuring accuracy in HSN coding is crucial for seamless trade and compliance.

Check the official EU Customs Database for listed commodities under EUDR, to match your products with the correct regulatory codes for compliance.