Contact: +91 99725 24322 |

Menu

Menu

Quick summary: Explore how Thailand’s rubber exporters can achieve EUDR compliance through digital traceability, geolocation mapping, and blockchain verification. Learn how platforms like TraceX simplify Due Diligence Statement (DDS) creation, ensure deforestation-free sourcing, and future-proof rubber exports to the EU market.

EUDR Compliance for Rubber Exporters in Thailand requires proving that all rubber and rubber-based products exported to the EU are deforestation-free, legally sourced, and fully traceable to their plantation of origin. Thai exporters must collect geolocation data, verify land legality, and submit Due Diligence Statements (DDS) through the EU’s central system. Given Thailand’s vast smallholder network, manual tracking is no longer viable. Digital traceability platforms now play a crucial role automating data capture, risk assessment, and documentation to help Thai exporters maintain EU market access, ensure sustainability, and build global buyer confidence.

Thailand is among the world’s leading producers and exporters of natural rubber. Between 2019 and 2022, Thailand’s exports of natural rubber to the European Union grew from approximately USD 1.32 billion to USD 2.19 billion, signalling strong relevance to European markets. Natural rubber and its intermediate products (e.g., latex, ribbed smoked sheets) dominate Thailand’s upstream export base; downstream manufacturing (tyres, finished goods) is less mature.

Rubber plantations are concentrated in southern and eastern Thailand but are expanding into northern, northeastern and central provinces. Originally planted on former fruit or agricultural lands, newer areas may pose higher deforestation risk. The supply chain is heavily smallholder-based: around 90% of production comes from small farms. This creates important implications for traceability and compliance. Upstream and midstream segments (harvest, latex concentration, sheet production) remain Thailand’s strength; downstream value-adding into tyres, gloves and finished rubber goods is growing but still lags.

Demand in global automotive and industrial sectors (especially tyres and related components) is driving higher rubber consumption. Thailand’s rubber industry is also responding to elevated price levels driven by supply disruptions adverse weather events reduced output and raised margins. Thai authorities and industry are increasingly shifting emphasis toward value-added processing, traceability systems, and compliance frameworks to align with global sustainability requirements.

For rubber producers and exporters targeting the EU, establishing verified traceability, geolocation mapping of plantations, and documentation of legal compliance will be critical to maintaining market access. Building downstream capability moving from raw rubber sheets to more finished goods can increase value captured locally and reduce exposure to commodity price swings.

Leveraging technology (e.g., blockchain tracking, automated origin verification) and digital traceability platforms positions Thai rubber firms ahead of regulatory curves and sustainability expectations. Thailand’s rubber export sector remains globally significant and increasingly intertwined with high-value markets such as the EU. The combination of scale, strategic importance and supply chain complexity means that Thai exporters face both opportunity and risk. With rising global demand and regulatory pressure, the firms that invest in traceability, compliance, and value-added processing will likely capture the greatest long-term advantage in the evolving rubber market.

The EUDR explicitly includes natural-rubber and certain rubber-derived products under its scope. Notable Harmonised System (HS) codes covered include: HS 4001 (natural rubber, balata, guayule, chicle and similar gums in primary forms or in plates, sheets or strips), HS 4005 (compounded rubber, unvulcanised, in primary forms or in plates/sheets), HS 4006 (unvulcanised rubber in other forms), HS 4008 (plates, sheets, strips etc. of vulcanised rubber), and HS 4011 (new pneumatic tyres made of natural rubber) among others. The regulation entered into force on 29 June 2023 and its main due-diligence obligations apply from 30 December 2025 for large and medium-sized operators, with extended compliance for micro- and small enterprises by 30 June 2026.

Master the step-by-step process of submitting Due Diligence Statements under the new EUDR rules.

Read the blog on filing DDS for EUDR compliance

Don’t wait until deadlines tighten learn how traceability, digital documentation, and risk intelligence can keep your exports compliant and competitive.

Read our latest blog on EUDR rubber regulations

About 90% of Thailand’s natural rubber production comes from smallholder farms spread across southern, eastern, and increasingly northern provinces. These smallholders often operate informal, fragmented supply chains with many intermediary traders, making end-to-end traceability difficult. Collecting farm-level geolocation data, verifying land tenure, and ensuring legality become major logistical and cost burdens for exporters. The risk: if smallholders can’t supply verifiable data, their rubber may be excluded from EUDR-compliant supply chains or face delays/penalties.

Thailand’s rubber sector has expanded into new areas and sometimes into land previously forested or sensitive. The EUDR prohibits placing commodities on the EU market if they originate from deforested land after 31 December 2020. This raises the stakes for rubber exported to the EU. Verifying that plantations were established legally and without deforestation requires historical land-use data, satellite imagery, and reliable records resources that many actors in the Thai rubber chain currently lack.

Thailand’s rubber supply chain includes many levels: smallholders → collection centres → processors → exporters. Aggregation at dealer/trader level can mix batches from multiple farms, making it hard to maintain a “clean,” verified path from farm to export. Dealers may operate with limited digital infrastructure or oversight, creating a critical compliance risk point. A single non-compliant batch can affect the entire chain’s access to EU markets.

Many farms and traders lack systems to capture and report geolocation, legality documents, harvest volumes, and chain-of-custody data in machine-readable formats. Exporters must now prepare for automated systems (such as EU’s information system under EUDR) which will demand high-quality data and traceability down to the plot level. Without such infrastructure, Thailand’s rubber firms face compliance risk.

Implementing traceability systems, training farmers and dealers, mapping plantations, and upgrading IT infrastructure all carry significant cost. As one article pointed out: “The complexity and cost of meeting the traceability standards could result in small-scale farmers being edged out.” At the same time, global rubber prices are volatile, and competition from lower-cost producers (e.g., Vietnam, Indonesia) further tightens margins. Thus, exporters must balance compliance costs with maintaining competitiveness in global markets.

While the EUDR sets a clear deadline and requirement, some exporters are still unclear about how the regulation will be implemented in practice (e.g., EU’s “information system,” risk assessment criteria, national frameworks). Uncertainty makes long-term investments riskier: exporters may hesitate to deploy large-scale traceability systems until more clarity emerges.

For Thailand’s rubber exporters, the EUDR presents both a major opportunity and a significant challenge. To maintain EU-market access and meet increasingly stringent sustainability expectations, the industry must navigate structural smallholder networks, strengthen data systems, and absorb compliance costs all while staying globally competitive.

The EU Deforestation Regulation (EUDR) mandates that rubber exporters demonstrate deforestation-free and legally sourced supply chains a significant challenge for Thailand, where over 90% of rubber production comes from smallholder farmers. TraceX’s EUDR Compliance Platform offers a fully digital, automated, and transparent solution that helps Thai exporters meet these requirements efficiently while strengthening market credibility.

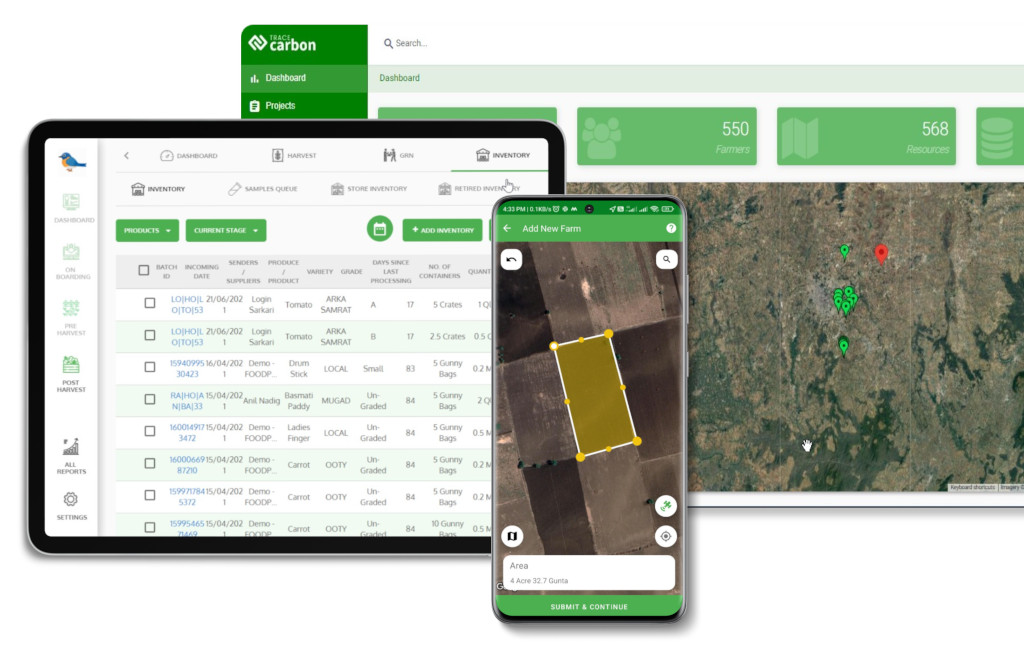

TraceX connects farmers, cooperatives, processors, and exporters in a unified ecosystem. Every rubber batch is assigned a unique digital ID linked to verified plantation geolocation and supplier credentials, ensuring an unbroken chain of custody from farm to export vital for EUDR compliance and audit readiness.

Through mobile apps, field officers can capture farm geolocation, ownership details, and legality documents in real time. The platform automatically generates EUDR-compliant Due Diligence Statements (DDS) for each shipment, drastically reducing manual effort, documentation errors, and audit preparation time.

Each transaction, from latex collection to processing and export, is securely recorded on a tamper-proof blockchain ledger. This immutable record offers verifiable proof of origin and legality, ensuring that rubber exports from Thailand can confidently demonstrate compliance with EU standards.

TraceX’s mobile-first onboarding tools enable easy registration and GPS mapping of smallholder farms, even in remote regions. Each farmer’s profile includes land ownership, sustainability certificates, and production data ensuring digital inclusion and compliance at the grassroots level.

Using satellite imagery and AI-driven analytics, TraceX identifies deforestation risks around rubber plantations, flags high-risk areas, and enables early corrective action protecting both compliance and brand integrity.

The platform acts as a single source of truth for exporters, suppliers, and regulators. Secure data sharing allows stakeholders to access verified, standardized information, simplifying audits and accelerating EUDR approvals.

By combining blockchain-backed transparency, AI-powered risk detection, and automated compliance workflows, TraceX helps Thailand’s rubber industry transform EUDR compliance into a strategic advantage ensuring sustainability, protecting smallholder livelihoods, and maintaining seamless access to EU markets.

EUDR compliance represents a fundamental shift for Thailand’s rubber industry from traditional trade practices to a data-driven, transparent, and accountable value chain. Under the regulation, Thai exporters must ensure that every shipment of rubber or rubber-based product entering the EU is deforestation-free, legally produced, and fully traceable to its plantation of origin.

This means rubber companies must geolocate all sourcing farms, verify land legality, and provide digital documentation proving that no deforestation occurred after December 31, 2020. Due Diligence Statements (DDS) must be submitted through the EU’s central information system for every export batch.

Non-compliance could result in shipment rejections, financial penalties, and loss of access to premium EU markets. Conversely, compliant exporters gain stronger buyer trust, faster customs clearance, and competitive advantage in sustainability-driven markets.

For Thailand home to over a million smallholder rubber farmers embracing EUDR compliance is not just about meeting regulation; it’s about future-proofing the industry, strengthening brand Thailand’s sustainability credentials, and unlocking opportunities in the global green economy.

EUDR compliance marks a defining moment for Indonesia’s rubber industry a chance to move from fragmented traceability to fully verifiable, sustainable sourcing. By adopting digital traceability platforms like TraceX, exporters can bridge data gaps, automate Due Diligence Statement (DDS) generation, and create an immutable record of deforestation-free sourcing. This not only ensures smooth EU market access but also builds long-term credibility with global buyers.

With blockchain-backed transparency and AI-driven risk monitoring, Indonesia’s rubber exporters can turn compliance into a competitive edge protecting livelihoods, restoring trust, and positioning Indonesian rubber as a globally sustainable brand.

Understand the key components of EUDR compliance and how to streamline your DDS process efficiently.

Read the blog on EUDR Due Diligence

Learn how AI-driven automation and intelligent workflows simplify data collection, verification, and reporting.

Explore the blog on Agentic AI for EUDR

Discover how digital onboarding bridges the gap between smallholders and EUDR compliance.

Read our blog: Smallholder Onboarding for EUDR Compliance

EUDR compliance requires Thailand exporters to prove that all rubber products are deforestation-free, legally sourced, and traceable to their plantation of origin before entering the EU market.

The EU is a major destination for Thailand’s rubber exports. Compliance ensures continued market access, strengthens buyer trust, and positions exporters as sustainability leaders in the global value chain.

Thailand exporters must map supply chains to the farm level, capture geolocation coordinates (GeoJSON), verify legal sourcing, and submit a Due Diligence Statement (DDS) via the EU portal before shipment.

Common challenges include fragmented smallholder networks, limited digital infrastructure, manual documentation, and lack of standardized traceability frameworks across the value chain.

Beyond meeting EU regulations, compliance drives supply chain transparency, builds brand credibility, enhances ESG performance, and opens access to premium global markets demanding sustainable rubber for the Thailand exporters.