Contact: +91 99725 24322 |

Menu

Menu

Quick summary: Discover how blockchain technology is reshaping the Voluntary Carbon Market, providing transparency and trust to drive sustainable climate action. Explore the transformative power of blockchain in our latest blog.

The global conversation on environmental sustainability has reached a critical juncture, and carbon emissions reduction is at the forefront. Among various strategies for mitigating climate change, carbon markets have emerged as a key tool. As individuals, businesses, and governments seek to offset their carbon footprints and contribute to a sustainable future, transparency, and trust within the voluntary carbon market are more vital than ever. Enter blockchain technology—a game-changer that promises to revolutionize the way we understand, engage with, and invest in voluntary carbon credits.

Current estimates suggest verification delays could cost project developers $2.6bn and waste 4.8 gigatonnes in unused credits by 2030.

This blog series is your gateway to exploring the transformative power of blockchain in the voluntary carbon market. Join us as we delve into the intricate fusion of environmental stewardship, technology, and financial innovation, and discover how blockchain is set to reshape the landscape of climate action, ushering in a new era of transparency and trust.

Before we delve into the voluntary carbon market, let’s establish a foundational understanding of carbon markets in general. Carbon markets are mechanisms that enable the buying and selling of carbon credits. These credits represent a reduction in greenhouse gas emissions. Essentially, they are certificates proving that an entity, whether an individual or a corporation, has taken measures to reduce their carbon footprint.

These credits can be traded, allowing carbon emitters to compensate for their emissions by purchasing these reductions.

Carbon markets come in two distinct flavors: compliance and voluntary. The compliance market is associated with legally mandated emission reduction targets set by governments. Companies operating in sectors with stringent regulations are obligated to participate and meet these requirements. On the other hand, the voluntary carbon market is, as the name suggests, voluntary. It caters to individuals and companies that want to offset their emissions voluntarily, often to showcase their commitment to environmental responsibility.

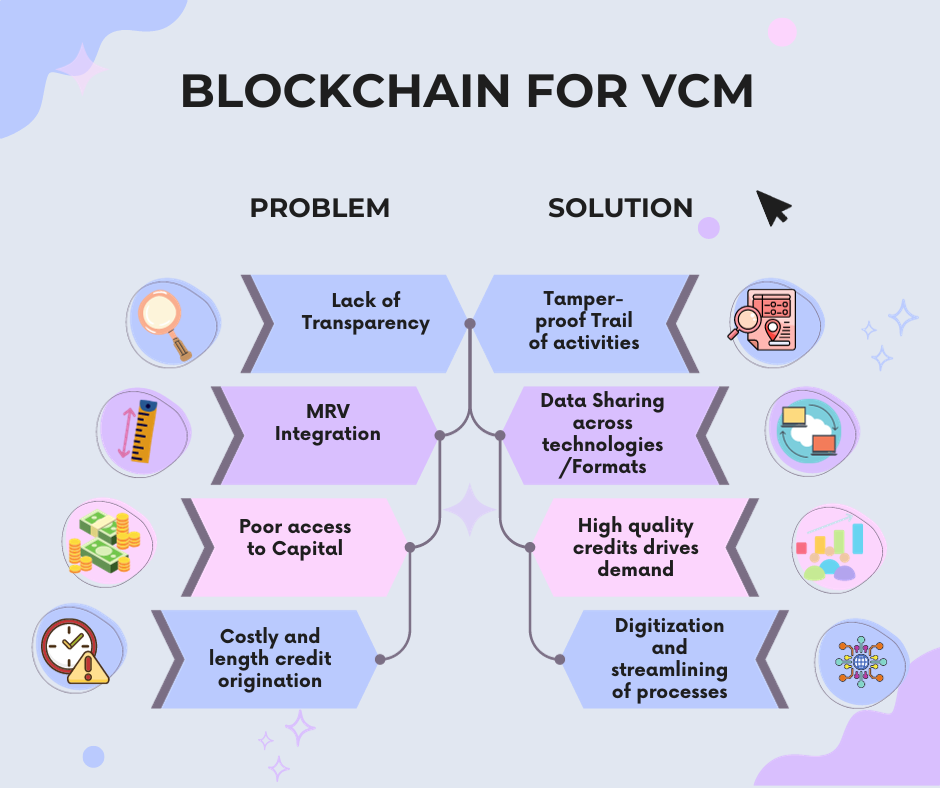

The voluntary carbon market is critical for supporting the efforts of those who wish to make a difference in the fight against climate change. However, it faces several challenges, most notably, the need for trustworthy and efficient carbon credit transactions. In this market, trust is paramount because, unlike the compliance market, there are no government-mandated regulations governing its operations. Therefore, participants need to have confidence in the quality and legitimacy of the carbon credits they are purchasing.

One of the most pressing challenges in the voluntary carbon market is the lack of transparency. Carbon credits are often traded in a decentralized and non-standardized manner, making it difficult to trace the origin and history of these credits. This opacity can result in double-counting, where the same carbon credits are sold multiple times, undermining the environmental impact of these transactions.

Intermediaries play a significant role in the carbon market, bridging the gap between buyers and sellers. While they provide valuable services in terms of facilitating transactions and verifying carbon credits, they can also introduce inefficiencies and additional costs. The lack of standardized processes for intermediaries further exacerbates these issues.

Quality control in the voluntary carbon market is a considerable concern. The credibility of carbon credits depends on their legitimacy, i.e., whether the emission reductions they represent are real and can be verified. Verifying the validity of these credits is often a complex and costly process, creating barriers for small and medium-sized enterprises to participate.

Blockchain technology, often associated with cryptocurrencies like Bitcoin, is a decentralized, distributed ledger that records transactions in a secure and transparent manner. Unlike traditional databases, blockchain is immutable, meaning once information is recorded, it cannot be altered. Each block in the chain contains a set of transactions, and these blocks are linked together, forming a continuous chain of data.

Blockchain technology has the potential to revolutionize the voluntary carbon market by enhancing transparency and traceability.

Double Counting: Each carbon credit is recorded as a transaction on the blockchain. This transaction includes detailed information about the credit’s origin, the methods used for emission reductions, and its transfer history. Because the blockchain is immutable and decentralized, all participants can trust the information on it. This solves the problem of double-counting as each credit’s unique identifier prevents it from being duplicated or sold multiple times.

Intermediaries: Blockchain’s inherent transparency will expose significant markups within the system. Furthermore, blockchain platforms facilitate direct communication between project developers and buyers. Buyers have the ability to search for credits that align with their preferences. All project details will be encoded within the credit, and sellers will not be subject to any fees.

Measuring and Reporting: Project developers have the capability to record both digital and analog measurement, reporting, and verification (MRV) data directly onto the blockchain. This streamlined process alleviates the burden on validation and verification bodies and crediting programs.

Verification Delays: Blockchain can enable real-time tracking of the verification progress for all parties involved. This transparency and visibility into the verification status can prevent delays by allowing proactive issue resolution. The transparent nature of blockchain ensures that all transaction and verification data is readily available and accessible to authorized parties.

Several blockchain projects have already been implemented in the carbon market, showcasing the technology’s potential. For instance, the Climate Ledger Initiative, a collaboration between leading organizations, aims to create an open source blockchain platform for carbon accounting. This project enhances the transparency of carbon credit transactions and helps prevent fraud. Similarly, the Verra Registry in partnership with IBM, utilizes blockchain to track carbon credits and verify their authenticity. These examples demonstrate the real-world applications of blockchain in addressing the challenges of the voluntary carbon market.

Tracex’s blockchain-powered DMRV system Trace Carbon, enhances the credibility of the VCM by introducing transparency, data integrity, automation, and security. These attributes instil trust among market participants and promote the issuance and trading of high-integrity carbon credits, ultimately strengthening the credibility of the VCM as a whole.

Blockchain’s inherent transparency ensures that all involved parties have access to an immutable and auditable ledger of carbon credit data. This transparency extends to the entire lifecycle of a carbon credit, from project inception to issuance, trading, and retirement. It eliminates the opacity often associated with traditional systems and promotes trust among stakeholders.

Once data is recorded on the blockchain, it cannot be altered or tampered with without consensus from network participants. This immutability safeguards the integrity of carbon credit records, eliminating the risk of data manipulation and ensuring that credits represent genuine emissions reductions.

Stakeholders can track the verification progress in real time, ensuring that all participants are aware of the current status of the verification process. The blockchain stores historical data, allowing auditors and participants to access past records and verify the legitimacy of carbon credits.

Blockchain’s transparency and immutability are key benefits for the voluntary carbon market. The technology provides a secure and tamper-proof record of every carbon credit transaction, making it easy for participants to verify the legitimacy of credits.

The blockchain’s decentralized nature reduces the risk of fraud and double-counting. Each carbon credit is uniquely identified, and its history is easily traceable. This feature prevents the same credit from being sold multiple times and ensures the authenticity of the emissions reductions.

By enhancing transparency and reducing fraud, blockchain builds trust among market participants. This trust leads to greater efficiency in carbon credit transactions, as parties can confidently engage in deals, knowing that the credits they purchase are legitimate and verifiable.

The streamlined and transparent nature of blockchain transactions also contributes to cost reduction. Intermediaries play a less significant role, and the standardized processes on the blockchain minimize the complexities associated with verification and auditing. This lowers overall transaction costs, making it more accessible for a broader range of participants

While we’ve been discussing the voluntary carbon market, it’s essential to recognize that the applications of blockchain extend beyond carbon credits. Other environmental markets, such as renewable energy certificates and water rights trading, can also benefit from the transparency and traceability that blockchain provides. The technology’s potential in these areas opens doors to more comprehensive solutions for environmental sustainability.

As the world continues to grapple with climate change, innovators and technologists are continually finding new ways to improve carbon credit management. For example, the use of Internet of Things (IoT) devices for real-time emissions monitoring and data feeding into blockchain ledgers could further enhance the trustworthiness of carbon credits. Additionally, artificial intelligence and machine learning can be employed to analyze historical data and assess the effectiveness of emission reduction projects.

While blockchain holds tremendous potential, it’s not without its challenges. One significant challenge is scalability. As more participants join the blockchain network, the volume of transactions increases, which can slow down the network. Addressing this issue requires technical solutions and continuous optimization.

Blockchain technology may face regulatory hurdles, especially in the context of carbon markets, which are subject to specific rules and standards. Policymakers and market regulators will need to adapt and create a supportive framework to ensure the seamless integration of blockchain in these markets.

Adopting blockchain in the voluntary carbon market will not be without hurdles. Participants will need to transition from their existing systems to blockchain-based platforms. This transition could be challenging, and it may require a collective effort from the industry to facilitate smooth adoption.

The voluntary carbon market is a critical instrument in the fight against climate change. However, it faces significant challenges related to transparency, trust, and efficiency. Blockchain technology offers a promising solution to these challenges by enhancing transparency, reducing fraud and double-counting, improving trust, and lowering transaction costs.

As we look to the future, blockchain’s applications in environmental markets extend beyond carbon credits. Other sectors, such as renewable energy and water rights, stand to benefit from the technology’s transparency and traceability. While challenges remain, including scalability and regulatory considerations, the potential for blockchain to transform the voluntary carbon market and drive global sustainability efforts cannot be overstated.

The time is ripe for the voluntary carbon market to embrace blockchain technology and usher in a new era of environmental responsibility and impact. With innovation, collaboration, and a commitment to a sustainable future, we can pave the way for a more transparent, trustworthy, and efficient carbon market that benefits our planet and generations to come.