Contact: +91 99725 24322 |

Menu

Menu

Quick summary: Discover 5 real-world EUDR examples to help your business ensure compliance with the EU Deforestation Regulation. Learn about the essential steps to navigate this complex regulation effectively.

With the stakes high and compliance requirements growing more stringent, many businesses are left grappling with the fear of hefty penalties or even losing access to the lucrative EU market. The complexities of EUDR is overwhelming to meet the new standards. Let us explore 5 EUDR examples that illustrate how different companies are tackling compliance in their operations.

Failing to comply with the EUDR can result in serious repercussions, including financial fines reaching 4% of yearly revenue, limited entry to the EU market, and considerable harm to reputation, leading to diminished consumer trust and loss of investor confidence.

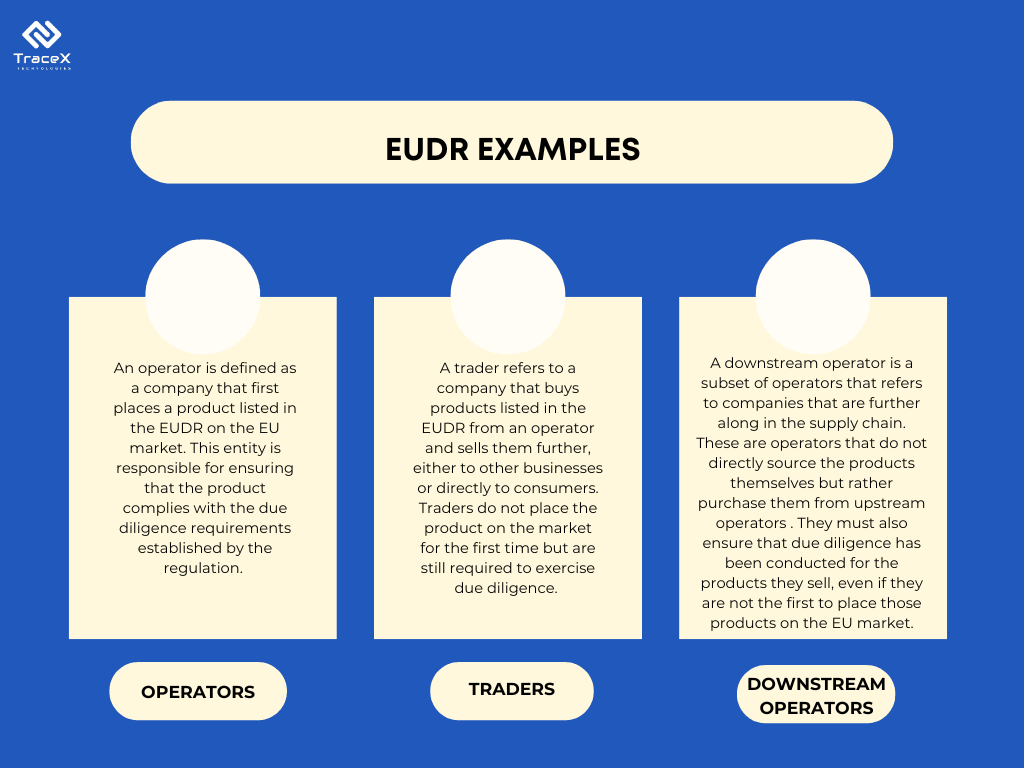

These scenarios will highlight both the challenges and practical steps businesses can take to align with the regulation, ensuring that their supply chains are not only sustainable but also legally sound. Whether you’re an operator, trader, or manufacturer, understanding these examples will empower you to take actionable steps toward compliance and peace of mind. So let’s dive in!

Key Takeaways

The European Union Deforestation Regulation (EUDR) is a groundbreaking piece of legislation aimed at combating global deforestation and forest degradation linked to the EU market. The EUDR compliance requires companies to ensure that products placed on the EU market do not contribute to deforestation, whether directly or indirectly. This includes a wide range of commodities such as palm oil, cocoa, coffee, and wood, as well as products derived from these raw materials.

The regulation mandates that businesses conduct rigorous due diligence to trace the supply chain of their products, ensuring they are sourced sustainably and legally. This involves collecting detailed information about the origin of raw materials, assessing risks associated with their sourcing, and implementing measures to mitigate those risks. The EUDR is designed not only to promote sustainable sourcing practices but also to align with the EU’s broader goals of environmental protection and climate change mitigation.

Understanding the EUDR’s scope is crucial for any company operating within the EU or exporting goods to the region. With the potential for substantial penalties and market access restrictions for non-compliance, it is essential for businesses to familiarize themselves with the regulation and take proactive steps toward compliance.

French Company A, imports palm oil from Indonesia

This palm oil is used to make soap by another company, French Company B, which also sells that soap within the EU.

Since palm oil is one of the products listed in the EUDR, French Company A has responsibilities as an “operator.” It’s the first to place palm oil on the EU market, which means it must comply with strict due diligence requirements. These include:

So, while Company A has to follow all the EUDR rules, Company B doesn’t have to worry about it.

Dutch Company A imports tropical sawn wood from Nigeria and sells it to German Company B and Spanish Company C, which use the wood to make furniture.

Now, since sawn wood is listed under the European Union Deforestation Regulation (EUDR), Dutch Company A is an “operator”. This means Company A has to follow strict due diligence steps

What about the furniture makers, German Company B and Spanish Company C?

Unlike the soap maker in the earlier example, both of these companies are “downstream operators” under the EUDR because the product they make—wooden furniture—is also listed in the regulation.

So, while all three companies are operators under the EUDR, their responsibilities vary depending on their size and position in the supply chain.

German Company D manufactures furniture from sawn wood that it previously imported and then sells it to two retailers: Italian Company E (a large retailer) and Austrian Company F (a small retailer/SME). These retailers then sell the furniture to businesses and consumers across the EU.

German Company D is a “downstream operator” because they are selling a product listed under the EU Deforestation Regulation (EUDR) (the furniture made from sawn wood). Since the furniture is made from a product already subject to due diligence (the wood), German Company D ensures that due diligence has been done properly by the supplier (Dutch Company A) and files a due diligence statement for the furniture it sells to Italian Company E and Austrian Company F.

Italian Company E is a large trader, meaning they don’t place the product on the market first, but they do buy and sell listed products. Since E is a large company, they also have to ensure that due diligence has been conducted. This means they must verify that German Company D has met all EUDR requirements and file a due diligence statement for the furniture before selling it to other businesses or consumers.

Austrian Company F, on the other hand, is a small trader (SME). As an SME, Austrian Company F doesn’t have to go through the full due diligence process. They simply need to keep records of who they bought the furniture from (German Company D) and the details of the due diligence statements filed. If they sell the furniture to other businesses, they must also track who they sold it to. However, no full due diligence or separate statement is needed in their case.

This setup highlights how responsibilities vary based on company size and position in the supply chain under the EUDR.

Imagine Swiss Company A imports cocoa beans from Ivory Coast. The cocoa beans arrive at an EU port, are offloaded, and stored in a warehouse before being shipped to the United Kingdom (UK), which is outside the EU.

You might think Swiss Company A would be subject to the EU Deforestation Regulation (EUDR) because cocoa beans are listed in the regulation.

But here’s the catch: Swiss Company A isn’t placing the cocoa beans on the EU market—they’re just passing through (what we call trans-shipping) and heading to the UK.

Since the cocoa beans aren’t entering the EU market, the EUDR doesn’t apply to Swiss Company A. In other words, customs warehousing, inward processing, or temporary admission don’t count as putting the product on the market for EUDR purposes. So Swiss Company A doesn’t need to worry about EUDR obligations in this case.

Now, if Swiss Company A decided to sell some of the imported cocoa beans within the EU and ship the rest to the UK, things would be different. For the beans sold in the EU, they would be considered an “operator” and required to follow the EUDR guidelines—this includes due diligence like ensuring the cocoa beans are deforestation-free and legally produced. The company would have to file a due diligence statement for the beans placed on the EU market.

As for the UK, they are in the process of introducing their own regulation around forest-risk commodities like cocoa, but it’s not in force yet and differs from the EUDR.

This example clarifies how the EUDR works depending on where products are placed on the market.

Imagine a Swiss company A that imports cocoa beans from Ghana. This company sells the cocoa beans to another Swiss company B. Company B is a chocolate manufacturer based in Switzerland, and they produce chocolate that they sell through their office in the EU to a Italian company C manufacturing biscuits

Swiss Company A imports cocoa beans from the Ghana but only sells them to Company B, which is also in Switzerland. Because both companies are based in Switzerland (a non-EU country), Company A doesn’t have any responsibilities under the EU Deforestation Regulation (EUDR). In this case, Company A won’t face any checks because they aren’t placing the cocoa beans on the EU market.

Swiss Company B, however, is a different story. They take those cocoa beans and turn them into chocolate, which they then sell through their EU office. This means they are the first company in this example to place a product (the chocolate) on the EU market. As such, Company B is considered an “operator” under the EUDR.

Since they are operating within the EU, they must ensure that their chocolate meets the EUDR criteria. This includes being deforestation-free and legally produced. Company B has to go through a due diligence process that involves:

For every batch of chocolate they sell in the EU, Company B must file a due diligence statement, which includes details like the geolocation of the farms where the cocoa beans were sourced.

Finally, we have Italian Company C. This company buys the chocolate from Company B and uses it to make biscuits. Since biscuits are not listed under the EUDR, Company C has no obligations regarding EUDR compliance. They can simply focus on producing and selling their biscuits without needing to worry about the due diligence requirements related to the cocoa.

This scenario illustrates how the EUDR affects different companies in the supply chain based on their roles and where they operate.

The TraceX EUDR Compliance Platform is designed to help businesses navigate the complexities of the European Union Deforestation Regulation (EUDR) effectively. Here’s how it aids companies in ensuring compliance:

1. Supply Chain Traceability: The platform provides a robust traceability system that allows companies to track the origin of their products. This feature is essential for businesses that need to demonstrate that their raw materials, such as palm oil or cocoa, are sourced sustainably and legally. By leveraging blockchain technology, it ensures that all transactions and movements of goods are recorded transparently and immutably

2. Due Diligence Automation: The platform automates the due diligence process, making it easier for companies to gather and manage the required information about their supply chains. This includes collecting geolocation data, verifying compliance with local regulations, and assessing risks related to deforestation. By simplifying these tasks, businesses can focus more on strategic decisions rather than getting bogged down in paperwork .

3. Risk Assessment Tools: The platform integrates with satellite monitoring solutions and equips users with tools to conduct risk assessments, identifying potential issues within their supply chains. This feature allows companies to evaluate whether their suppliers are operating in high-risk areas for deforestation and to take necessary actions to mitigate those risks

4. Reporting and Documentation: The platform facilitates the generation of necessary compliance documentation, including Due Diligence Statements (DDS). This ensures that businesses have the required paperwork to demonstrate their compliance with the EUDR when placing products on the EU market .

5. Integration with Existing Systems: The platform can seamlessly integrate with a company’s existing supply chain management systems, allowing for a smooth transition to EUDR compliance. This interoperability is vital for companies looking to enhance their compliance processes without overhauling their entire operations.

Ensuring compliance with the EU Deforestation Regulation (EUDR) is crucial for businesses involved in the import and sale of commodities at risk of contributing to deforestation. By examining real-world EUDR examples, companies can better understand their responsibilities and the measures they need to implement to remain compliant. From utilizing comprehensive due diligence processes to leveraging technologies like the TraceX EUDR Compliance Platform, businesses can navigate the complexities of the EUDR effectively. As regulations evolve, staying informed and adaptable will be key to not only meeting compliance requirements but also promoting sustainable practices that benefit both the environment and business operations.

The EU Deforestation Regulation (EUDR) aims to prevent products linked to deforestation from entering the EU market. It sets out due diligence requirements for businesses involved in the supply chain of specific commodities at risk of contributing to deforestation.

Companies that import, sell, or distribute products listed under the EUDR, such as palm oil, cocoa, and coffee, are required to comply. This includes both operators who place products on the EU market and traders who purchase these products from operators.

Companies can ensure compliance by implementing robust due diligence processes, utilizing technology for supply chain traceability, conducting thorough risk assessments, and generating the necessary documentation to demonstrate compliance. Platforms like TraceX can significantly streamline these processes