Contact: +91 99725 24322 |

Menu

Menu

Quick summary: Discover how to navigate EUDR Rubber Regulations with ease. Learn who must file DDS, manage plantation geolocation, handle multi-port imports, and stay audit-proof with digital traceability. A complete compliance handbook for rubber exporters, importers, and EU operators.

Is Your Rubber Supply Chain Ready for EUDR – Or Are You at Risk of Losing EU Market Access? EUDR rubber regulations are no longer a distant requirement; they’re here, and they’re changing the way rubber producers, manufacturers, importers, and retailers do business. If you can’t prove that your rubber is deforestation-free, your shipments could be rejected, contracts cancelled, and your business shut out of the EU market.

According to Carbon Brief, new research reveals that rubber plantations in Southeast Asia have contributed to the loss of over 4 million hectares of tropical forests in the past three decades. This alarming figure highlights the urgent need for sustainable rubber production and stricter regulations to protect biodiversity.

Rubber supply chains are complex and fragmented, with raw latex sourced from millions of smallholder farms across tropical regions. Tracking every supplier, verifying deforestation-free sourcing, and maintaining audit-ready documentation is overwhelming, especially with manual processes. But compliance doesn’t have to be a burden; it can be a competitive advantage. This guide is your complete EUDR rubber compliance handbook, breaking down everything you need to know, from geolocation tracking and supplier verification to blockchain-powered traceability and risk assessment tools.

Key Takeaways

The EU Deforestation Regulation (EUDR), formally Regulation (EU) 2023/1115, came into force in June 2023 and is one of the most ambitious supply chain due diligence laws globally. Its purpose is simple but powerful: ensure that key commodities entering the EU market are not linked to deforestation or forest degradation.

The regulation covers seven major commodities: soy, cattle, palm oil, coffee, cocoa, timber, and rubber. For rubber supply chains, this means not only raw natural rubber but also a wide range of derivative goods, including:

This makes rubber unique compared to other commodities: it’s both an agricultural raw material and a critical industrial input in automotive, mining, and manufacturing. The regulatory reach extends far beyond plantations to the entire downstream ecosystem of tires, distributors, and OEMs.

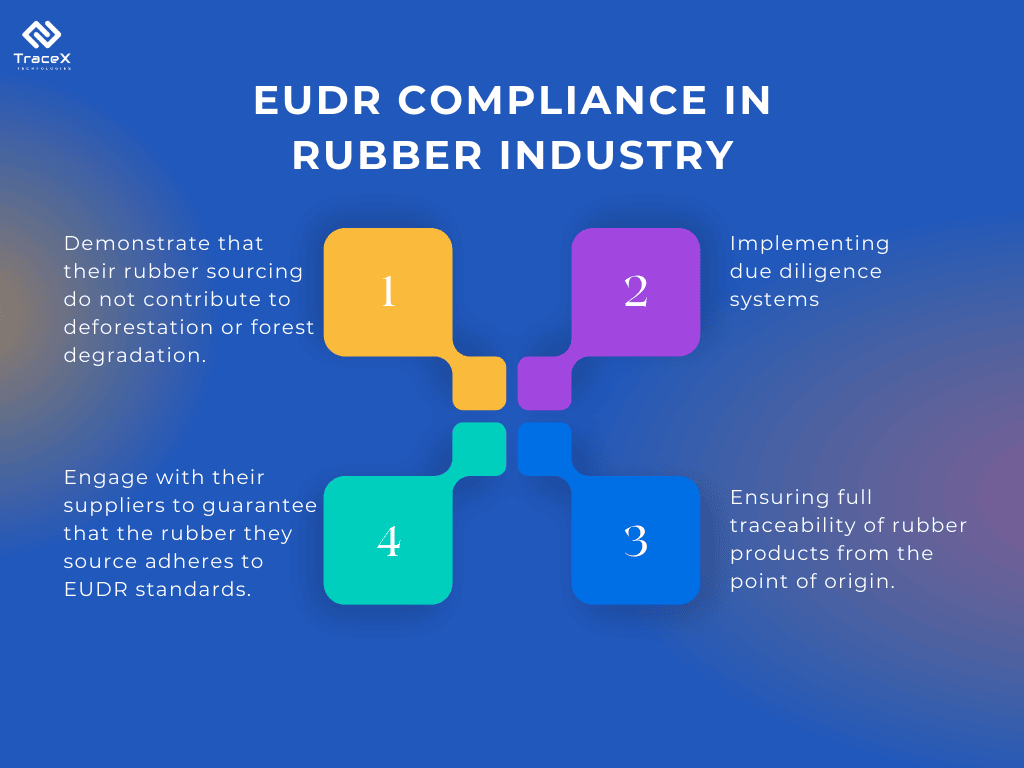

At the heart of EUDR is the Due Diligence Statement (DDS), which must be filed in the EU’s TRACES system before products can be placed on the market or exported. For rubber, this means operators must:

A single missing polygon in a GeoJSON file or a mismatch in supplier references can lead to TRACES rejection, delayed shipments, and costly demurrage fees.

Unlike cocoa or coffee, where compliance sits mostly with exporters and importers, rubber faces double pressure:

This dual challenge makes rubber the stress test of EUDR, and why technology-driven solutions like GeoJSON validation, AI risk scoring, and automated DDS generation are rapidly becoming must-haves.

EUDR is reshaping export markets for natural rubber. Don’t let compliance gaps cost you EU access

Explore our blog on EUDR’s Impact on Indian Rubber Producers to understand risks, requirements, and digital solutions.

Tire supply chains are in the spotlight under EUDR.

Learn how to manage multi-SKU traceability, supplier geolocation, and TRACES filings in our latest blog on EUDR Compliance for Tire Manufacturers.

1. Raw Material Sourcing (Rubber Plantations & Smallholder Farms)

EUDR Data Required:

2. Processing & Manufacturing (Rubber Sheets, Blocks & Latex Concentrates)

EUDR Data Required:

3. Importing to Europe (Regulatory Compliance & Trade Documents)

EUDR Data Required:

4. Trade Distribution Centers (Bulk Handling & Storage)

EUDR Data Required:

5. Regional Distribution & Retailers (Final Product Traceability)

EUDR Data Required:

Rubber may not get the headlines that palm oil or cocoa do, but under the EUDR Rubber Regulation, it is one of the most complex commodities to manage. Here’s why operators and traders face disproportionate compliance risks:

Rubber is cultivated across India, Africa, Southeast Asia, and increasingly Latin America. Each region has different land tenure systems, documentation practices, and levels of governance. For EU importers, this creates a patchwork of supplier risk profiles.

Unlike cocoa, which is concentrated in West Africa, rubber has a more fragmented geography — meaning no single risk template works across the board. Companies need adaptive risk scoring, not one-size-fits-all due diligence.

EUDR requires polygon-level geolocation for plantations, not just point coordinates. Smallholders often farm fragmented plots, making it difficult to capture precise geodata. Errors in CRS, boundary overlaps, or missing polygons lead to TRACES rejections.

Rubber geolocation is harder than timber or soy because smallholders often sell latex through intermediaries. That makes AI-powered polygon validation + auto-correction tools a game-changer for compliance.

Rubber supply chains don’t move one product, but many: latex concentrate, crumb rubber, smoked sheets, block rubber, and finished tires. Each SKU must trace back to plantation-level geolocation. When materials are blended or processed into composites, maintaining parent-child traceability becomes critical.

Rubber is the perfect example of why batch traceability systems are essential under EUDR, because what starts as a drop of latex might end up in a mining tire, and regulators will expect proof of origin.

Rubber is one of the most globally traded commodities, often entering Europe through multiple ports (Rotterdam, Antwerp, Hamburg, Barcelona) with different customs brokers. Each port filing creates the risk of inconsistent DDS references, duplicate submissions, or missed declarations.

Rubber importers are especially exposed here. Unlike single-port importers (e.g., niche cocoa traders), rubber distributors often use several brokers across hubs. Without a centralized DDS system, they face higher audit exposure.

Rubber isn’t just another commodity under EUDR, it’s the compliance stress test. Multi-country sourcing, geolocation complexity, multi-SKU traceability, and fragmented port entries mean operators must rethink compliance from manual spreadsheets to AI-powered, audit-proof platforms.

The EUDR Rubber Regulation makes it clear: responsibility for filing the Due Diligence Statement (DDS) lies with the operator, but roles vary across the supply chain.

The operator is the first EU-established entity that places rubber products on the EU market.

Traders, downstream wholesalers, distributors, or retailers, don’t file DDS themselves. Instead, they have a record-keeping duty for 5 years.

Non-EU suppliers, plantations, processors, manufacturers, never file DDS. Instead, they must provide:

Filing obligations for rubber are not spread across the chain. The operator files the DDS, but success depends on exporters supplying clean data and traders maintaining robust records. Rubber importers who centralize these roles into one digital workflow avoid the biggest compliance trap: gaps between upstream evidence and downstream filing.

The EUDR Rubber Regulation places operators at the front line of compliance, but rubber supply chains present unique hurdles compared to other commodities. Here’s where most operators struggle, and how to fix it.

EUDR requires polygon-level geolocation of rubber plantations, not just single GPS points. Many smallholders farm scattered micro-plots, often without a consistent CRS (coordinate reference system). These mismatches can break DDS submissions in TRACES.

Unlike timber (where plots are large and well-documented), rubber sourcing is smallholder-heavy. This makes GeoJSON validators and AI-driven boundary correction non-negotiable tools to standardize geodata and avoid costly rejections.

Rubber rarely travels as one SKU. It transforms, latex → smoked sheets → crumb rubber → tires → components. Each conversion stage risks breaking the link back to the original plantation. Without parent-child batch IDs, traceability collapses.

Rubber is the ultimate traceability stress test. Operators who sync ERP/WMS systems with compliance dashboards can build end-to-end batch lineage, ensuring auditors can follow the chain from tree to tire.

Most EU rubber shipments don’t flow through a single entry hub. Importers use Rotterdam, Antwerp, Hamburg, and Barcelona, often with different customs brokers. Each port risks fragmented DDS filings or duplicate submissions.

Filing consistency matters more than the number of ports. Operators must shift from port-level compliance to a centralized DDS dashboard with direct TRACES integration, ensuring one version of truth for every shipment.

Operators depend on upstream exporters for supplier DDS references, but too often:

Think of supplier DDS as the currency of compliance. Without automated validation at onboarding, operators gamble with every shipment. Platforms that reconcile references in real-time turn supplier onboarding into a compliance safeguard rather than a bottleneck.

Rubber operators can’t rely on manual spreadsheets or broker patchwork to meet EUDR. With plantation geodata complexity, SKU transformations, multi-port filings, and supplier gaps, compliance becomes a moving target. Only digital-first strategies AI validation, batch traceability, centralized dashboards can make rubber DDS audit-proof.

Rubber operators face one of the most complex compliance landscapes under the EUDR Rubber Regulation, but TraceX EUDR Compliance Platform transforms this into a streamlined, auditable process with AI and automation.

Instead of manually piecing together supplier data, geolocation files, and shipment details, TraceX auto-generates DDS drafts aligned to the TRACES schema. With one click, operators can file directly to TRACES, cutting prep time by up to 80% and reducing error risk.

What normally takes days of coordination across brokers and suppliers can be completed in minutes.

TraceX runs real-time checks on supplier data against satellite imagery, deforestation risk indices, and DDS consistency. High-risk suppliers are flagged before shipments leave port.

This flips compliance from reactive (fixing errors after rejection) to proactive (stopping risks before filing).

Every batch of rubber can be assigned a QR code provenance journey, linking plantation polygons → supplier → shipment → importer → DDS. Auditors, buyers, or regulators can scan and instantly view compliance lineage.

In a market where trust is currency, QR provenance becomes a competitive advantage, not just a compliance tool.

EUDR requires operators to maintain records for 5 years. TraceX securely stores all DDS filings, supplier documents, and geolocation files in the cloud with full version control.

No more chasing old files across brokers or emails during audits. Everything is audit-ready in one place.

TraceX integrates with existing ERP systems (SAP, Oracle, Microsoft Dynamics) and certifications (FSC, PEFC, ISO). This ensures compliance workflows don’t disrupt daily operations.

Operators don’t need to overhaul their systems, TraceX becomes an add-on compliance layer.

These scenarios show that while operators carry legal liability, exporters and traders shape how smooth (or painful) the process is. TraceX bridges the gap, validating GeoJSONs, centralizing filings, and linking sustainability data into one audit-proof chain of custody.

The EUDR Rubber Regulation brings unprecedented scrutiny to rubber supply chains. With multi-country sourcing, plantation-level geolocation, multi-SKU transformations, and fragmented port entries, compliance is undeniably complex. But the rules are also clear:

The cost of getting it wrong is steep, rejected DDS filings can trigger shipment delays, penalties, and even port seizures. For rubber operators working with high volumes and multiple entry points, one error can mean millions in blocked inventory and reputational damage.

The good news: with the right digital solutions, EUDR doesn’t have to be a bottleneck. Platforms like TraceX simplify DDS filing through AI-powered risk scoring, GeoJSON validation, centralized dashboards, and automated TRACES submissions. Compliance becomes not just manageable but scalable.

Struggling with DDS filing? Our blog on EUDR Due Diligence breaks down filing requirements, common errors, and smart fixes.

“From plantation to port, see real-world EUDR Rubber Supply Chain Examples that show how operators, traders, and exporters handle compliance.

“Manual compliance won’t scale. Discover how Digital Traceability streamlines EUDR filing, making it faster, more audit-proof, and future-ready.

The operator — the first EU-established entity placing rubber products on the EU market — must file the Due Diligence Statement (DDS) in TRACES. Non-EU exporters provide geolocation and compliance data, but the legal filing responsibility always stays with the EU-based operator.

No. Traders and retailers don’t file DDS. Instead, they are required to store supplier records and DDS references for at least 5 years. They remain audit-exposed if they can’t produce documents but are not responsible for TRACES submissions.

Yes, if it’s one shipment split across multiple EU ports, a single DDS can cover it. However, separate shipments require separate DDS filings, even if they use the same operator or ports. The European Commission assesses compliance by shipment boundaries, not port count.