Contact: +91 99725 24322 |

Menu

Menu

Quick summary: There is a climate emergency now and incremental steps to address GHG emissions are not enough. Companies need to adopt every strategy to achieve emission reduction goals and Carbon Offsets is one such tool, if used responsibly can accelerate your journey to net zero. While carbon offsets refer to the projects and activities that reduce CO2 in the atmosphere, carbon credits represent a specific unit, one metric tonne of carbon dioxide removed from the atmosphere

Carbon offsets have emerged as a powerful tool to mitigate the environmental impact of businesses and individuals. Striving for net zero emissions. But navigating the world of carbon offsets isn’t always straightforward. Many organizations struggle with questions like: Are these offsets credible? How do I ensure they align with my sustainability goals? The lack of clear guidelines and the presence of low-quality offset projects can lead to wasted investments and reputational risks.

According to Bloomberg NEF, the carbon offset market could see demand rise to 1.6 billion credits by 2030 and 5.1 billion credits by 2050 if integrity issues are resolved and demand becomes inelastic. Conversely, if current challenges persist, demand may only reach 1 billion credits annually in 2030 and stabilize at 2.5 billion by 2050

Without a proper understanding, carbon offsetting can feel like a minefield rather than a meaningful climate solution. This guide provides a concise and practical understanding of carbon offsets to help you navigate sustainability efforts effectively. Whether you’re a business aiming for net-zero emissions or an individual committed to reducing your carbon footprint, this guide equips you with the knowledge to leverage carbon offsets effectively and responsibly.

Key takeaways

Carbon offsets are reductions of greenhouse gas emissions or increase carbon storage via afforestation or land restoration that a company can use to offset emissions created in other locations.

Also referred sometimes as carbon credit, one offset credit is worth the equivalent of one metric ton of carbon dioxide or other GHG.

Offsets provide benefit to climate change regardless of location. Whether the emissions are being reduced at one location or helping to facilitate carbon emissions reducing project elsewhere, the impact on the planet is the same.

Companies can by paying someone else to reduce their emissions or reduce carbon can compensate for their environmental footprint and use carbon credits to achieve carbon neutrality.

Though used interchangeably, there is a subtle difference between an offset and a credit. While carbon offsets refer to the projects and activities that reduce CO2 in the atmosphere, carbon credits represent a specific unit, one metric tonne of carbon dioxide removed from the atmosphere. A unit like this makes carbon credits transferable ie. One organization can sell the unit to another organization to compensate for the GHG the company emits. This transferable instrument certified by governments or independent certified bodies represent an emission reduction of one metric tonne of CO2 or an equivalent amount of other GHGs. The purchaser of the offset credit needs to retire the credit to claim the reduction towards their GHG reduction goals.

This paves way for carbon markets that facilitate trading of carbon credits, denominated in USD per tonne of Co2.They help organizations to meet their net zero commitments and helping to fund projects that can reduce, avoid or remove carbon emissions from the atmosphere.

The world needs to reduce emissions in order to meet the Paris agreement thresholds of 1.5˚C. The path to net zero by 2050 is possible only if global emissions are halved by 2030. By 2050, CO2 emissions will need to reach ‘net zero’ where emissions are in balance with removals to sustain a chance of avoiding effects of climate change. One third of the cost-effective emission reductions required can be met with Nature Climate Solutions which aims to protect, restore and manage forests, soils and wetlands. Nature Climate Solutions refer to the conservation, restoration and improved land management that increases carbon storage and avoids greenhouse gas emissions. Avoiding deforestation, sequestering emissions and restoring peatlands are few of the climate mitigation pathways to reduce emissions.

There is a climate emergency now and incremental steps to address GHG emissions are not enough. Companies need to adopt every strategy to achieve emission reduction goals and Carbon Offsets is one such tool, if used responsibly can accelerate your journey to net zero.

A carbon offset lifecycle starts with reduction in emission and not all reductions qualify as an offset. It needs to meet a specific quality criterion based on the methodology used related to the kind of carbon project like energy, forests, livestock wherever reduction take place. Methodologies help to quantify the impact of carbon reduction.

In 1992, the Kyoto Protocol outlined the first offset provision under the Clean Development Mechanism (CDM) which allowed companies to offset their emissions by investing in environment positive projects. This led to the establishment of “Compliance Markets” for carbon credits.

These methodologies are complex as carbon projects differ with a number of variables that need to be accounted for along with accuracy. There is a need to evaluate the impact using the methodology after which a project can be developed.

These developers apply standards to review the project against the methodology which involves gathering scientific data that needs to be validated. Using the methodologies, the project activities are outlined, and a baseline is established for reduction of emissions. These efforts then need to be reviewed and certified by an independent third-party validator who acts on behalf of the standard. All offset programs require a third party auditor to validate a project’s baseline and the projected and achieved emission reductions.

Once a project is validated, it is ready to be officially registered and approved with a carbon offset program. It is now ready to start generating carbon offsets.

Verification is a key in these projects. Firstly, they need to meet the program’s eligibility criteria and secondly validate that data was collected in accordance with the program requirements and the calculations were estimated according to approved methodology and protocol. Projects are verified to ensure integrity and quality of data and there is transparency and accountability in the carbon market.

As these offsets travel through the journey of methods, validation and verification it enters the next phase of trading ie . buying and selling of offsets. This is where Carbon markets come into play.

Carbon Offset markets also referred to as Emissions Trading or Carbon Trading markets, form a crucial part of worldwide initiatives aimed at combating climate change and curbing greenhouse gas emissions. These markets function on the premise that entities, be it businesses, industries, or individuals, can offset their own emissions by participating in projects that either reduce or eliminate a commensurate volume of emissions from the environment.

There are two kinds of Carbon markets.

Countries and governments that have adopted the emission limits established by the Kyoto protocol and the UNFCC have to legally offset their emissions via a Compliance market. This is a mandatory market and are regulated by national, regional or international carbon reduction organizations.

The voluntary carbon market on the other hand allows businesses, organizations and individuals to offset their unavoidable emissions by voluntarily purchasing carbon credits by projects targeted at reduction or removal of GHGs. The voluntary market has multiple standards in place which are limited to different types of projects, different locations and are not regulatory in nature.

The price of carbon offsets is expected to vary significantly based on market conditions:

Trading of Carbon offsets mandates its verification, and this is done by third party standards like the Verified Carbon Standard (Verra), Climate Action Reserve (CAR) or the American Carbon Registry (ACR). The verification process evaluates the calculations of the actual avoided or contained GHG emissions to determine the integrity of the credit. The verification process takes three to six months depending on the complexity of the project and the company.

In a high-quality scenario where integrity is restored, prices could reach approximately $238 per ton by 2050. Under a voluntary market scenario with unresolved integrity issues, prices may only reach $14 per ton in 2050, reflecting a lack of confidence in the market

While trading offsets, the offset needs to be verified as a high-quality carbon offset.

The issuance of this credit should make a positive impact on the world than if you offset that much GHG emissions yourself.

The Quality has two aspects:

If the GHG reductions would have happened anyway ie. In the absence of a market for offset credits, then they are not additional. Additionality is essential for the quality of carbon offset credits. In case the associated GHG reductions are not additional, then purchasing offset credits in lieu of reducing your own emissions will worsen the climate change.

Overestimation occurs due to overestimating baseline emissions or underestimating actual emissions. Baseline emissions are the reference against which GHG reductions are calculated and are closely ties to additionality. Baselines are easier to determine for some projects and some are uncertain. While a project that captures methane from landfill and destroys it, the amount of methane emitted is generally equal to the amount that is captured and destroyed. Whereas there can be uncertainty in estimating how much GHG emissions will be displaced on an electricity grid by a solar power project leading to overestimation.

Many kinds of carbon offset projects reduce but do not eliminate GHG emissions. A project will have both intended and unintended effects on GHG emissions. If quantification methods fail to account for GHG emission increases caused at some sources indirectly, then net GHG reductions will be overestimated.

The effects of CO2 emissions are very long lived. Most of the carbon in a tonne of CO2 removed will be removed from atmosphere, however around 25% remains in the atmosphere for thousands of years. To compensate for this, the offset credits must be associated with GHG reductions that are similarly permanent. It no longer serves as a compensatory measure if the GHG reduction is reversed.

Carbon offset credits must be an exclusive claim to GHG reductions. If two different companies were to claim the same 100 tonnes worth of CO2 reductions, they would claim 200 tonnes as a total, but the actual reduction would be just 100 tonnes. This double counting occurs if more than one offset credit is issued for the same GHG reduction. An example would be if both the producer and consumer of biofuels claim GHG reductions associated using same litres of fuel and an offset is issued to both in spite of the overlap.

Double counting occurs also if two different parties count the same offset credit towards their GHG reduction claims. Double claiming can also happen if offset credits are issued to a project but another entity like government or a company may count the same GHG reduction towards its own GHG reduction goal.

A project should not contribute to social and environmental harm while producing a high-quality offset. The project should comply with all legal requirements in the jurisdiction where it is located.

Carbon credit certification is done by third party companies. They apply certain rules to the program to ensure it meets their standards and then the certificate is issued. Once certified, the company can retire the credit to offset its own GHG emissions or trade the credit to other organizations or individuals. The companies that perform carbon credit certification are Verra, Gold Standard and the SCS Global Services

Carbon Credits cost $3 to $5 per tonne of carbon emissions today, the prices of which are to see a huge rise in the next decade

Every tonne of emissions reduced by an environmental project creates one carbon offset or carbon credit. These reductions are also called the Verified Emission Reductions (VERs) are independently audited against a third-party verification standard. Normally the traditional offset projects include reforestation, forest management, methane gas capture and destruction and fuel switching. Before any GHG reduction can be certified for use as a carbon offset, they must meet certain quality criteria. Carbon offset programs have approved methodologies or protocols that cover project types.

Some of the Verified Emission Reduction Standards in the VCM market are

All credits issued from these major carbon standards would have undergone an in-depth verification process by an accredited third-party verifier. Another part of verification is the Registration on a Carbon Offset registry to ensure an offset is not double counted.

Standard bodies related to carbon offsetting serve as valuable resources for identifying and accessing registered carbon offset projects. These organizations establish and maintain guidelines, criteria and standards that carbon offset projects must adhere in order to be considered legitimate and effective in reducing greenhouse gas emissions.

A Carbon offset Registry is responsible for tracking offset projects and issuing credits for GHG emission reductions or removals. These credits then get converted to credible, fungible commodities. The registries are systems for reporting and tracking offset project information including credits generated, ownership, sale and retirement. A serial number is assigned to each credit for tracking. Once an organization retires a credit ie they use it to offset emissions, the registry retires the serial number to prevent any double counting.

Few of the registries are the American Carbon Registry, Verra and Markit.

Carbon offsetting projects are available in the areas of renewable energy, biochar, forestry, bio-oil, methane capture, livestock, REDD+ and soils. Companies can reduce their carbon footprints by doing offsets and can also become carbon negative by doing extra offsets to remove the environmental harm. While some companies reduce carbon emissions and offset what they cannot reduce, other companies emit as much and offset it elsewhere through tree planting projects and renewable energy farms. This paves way for Carbon Neutrality.

Carbon Neutrality goals are growing and are ambitious. The benchmark for a science based GHG reduction target is achieving net zero emissions by 2050. However, it would be tempting to rely on offsets as a primary way of meeting carbon neutrality. In fact, all carbon emissions must cease altogether, the focus should be on reducing GHG emissions directly in line with the global mitigation goals. Organizations need to use offsets only on top of their efforts to reduce emissions to net zero by 2050.

Reduce what you can, offset what you cannot.

While carbon offsets are a promising solution for mitigating climate change, they come with several challenges that businesses and individuals must navigate to ensure their effectiveness:

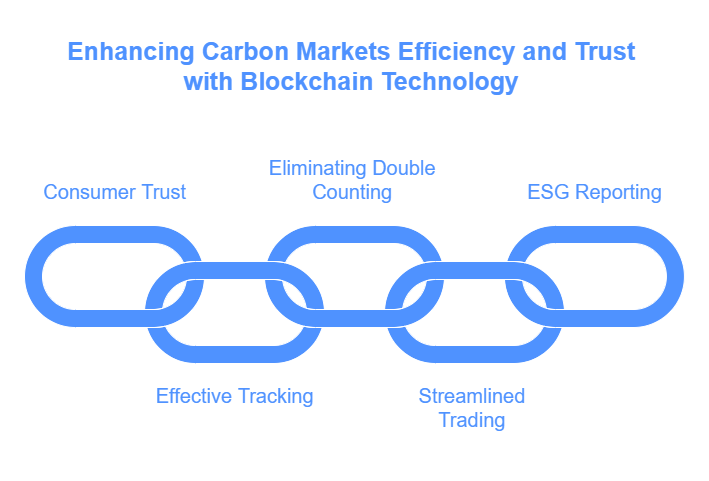

Addressing these challenges requires a combination of transparent technologies (like blockchain-based DMRV platforms), adherence to stringent standards, and a focus on balancing emissions reductions with offsetting efforts.

A number of countries want to participate in carbon markets to help them meet their climate change goals. More than two thirds of the countries are planning to use carbon markets to meet their NDCs towards the Paris agreement. Blockchain technology is revolutionizing this carbon sector by ensuring transparency where only one country can claim a particular carbon credit. The key to successfully reducing GHG emissions through carbon markets can be through a digital platform that keeps the verified data secure and ensures that all measurements and reductions are accurately tracked and verified. Digital Monitoring systems play an important role in carbon management.

Blockchain technology provides a solution by monitoring and reporting emission reduction trading, eliminating double counting, improving finance flows and building trust through transparency.

The TSVCM report projects a growth of $180 billion of the Voluntary carbon market by 2030. Blockchain technology boosts transparency lowers the transaction costs and allows resource transfers and recording of transactions via a secured DLT. The distributed ledger links all the players on a shared platform and enables a transaction record without a third party. The ledgers are immutable and tamper proof assuring a single source of truth for auditing purpose.

The TraceX Digital Measurement, Reporting, and Verification (DMRV) platform is a game-changer in the carbon offset landscape, enabling businesses and carbon project developers to achieve transparency, credibility, and efficiency in their sustainability efforts.

In the context of carbon offsets, the TraceX DMRV platform streamlines the critical processes of tracking, measuring, and verifying carbon reductions or removals. It ensures that offset projects, whether focused on afforestation, renewable energy, agroforestry, or community-based initiatives, are accurately monitored in real-time using advanced technologies like blockchain, IoT, and satellite imagery.

The platform addresses one of the biggest challenges in carbon markets: the credibility of offsets. With blockchain-enabled traceability, TraceX ensures tamper-proof records, enabling project stakeholders to validate the authenticity of carbon reductions while meeting rigorous carbon offset standards such as VCS or Gold Standard.

Moreover, TraceX simplifies compliance reporting by automating the generation of auditable data for regulatory bodies and voluntary market participants. This not only builds stakeholder trust but also reduces operational inefficiencies and costs.

With TraceX DMRV, businesses can confidently participate in carbon markets, deliver high-quality offsets, and contribute meaningfully to global net-zero goals, while enhancing transparency and accountability across the offset lifecycle.

Carbon offsets are a powerful tool in the fight against climate change, enabling businesses and individuals to take responsibility for their emissions. By investing in credible offset projects, adhering to rigorous standards, and leveraging innovative platforms like TraceX’s DMRV, stakeholders can drive impactful change. As you navigate the carbon offset journey, remember that transparency, authenticity, and alignment with sustainability goals are key to making a difference. Together, we can pave the way for a carbon-neutral future.

Carbon offsets are measurable, verified reductions in greenhouse gas emissions from nature based projects, such as afforestation or renewable energy. They allow businesses and individuals to compensate for their own emissions by supporting these initiatives.

To ensure credibility, choose projects verified by recognized standards like Gold Standard or VCS. These standards enforce rigorous monitoring, reporting, and third-party validation of emission reductions.

A DMRV platform like TraceX ensures accurate measurement, reporting, and verification of carbon reductions, enhancing transparency and trust in the carbon offset process. It streamlines compliance and boosts the impact of sustainability initiatives.