Contact: +91 99725 24322 |

Menu

Menu

Quick summary: Explore the essentials of voluntary carbon markets (VCM), including their key principles, differences from compliance markets, participant roles, and carbon pricing. Discover how TraceX’s Digital MRV (DMRV) platform addresses VCM challenges and enhances market integrity.

Climate change is no longer a distant threat, but an imminent reality and voluntary carbon markets have emerged as a vital tool for both businesses and individuals committed to reducing their carbon footprint. However, navigating these markets can be challenging, with complexities that often obscure their true potential. Many organizations struggle to understand how VCM operate and how they can effectively leverage them to meet sustainability goals.

The VCM is a critical component of global climate action, offering a platform where organizations and individuals can purchase carbon offsets to mitigate their carbon footprints.

According to McKinsey, demand for carbon credits could increase by a factor of 15 or more by 2030 and by a factor of up to 100 by 2050. Overall, the market for carbon credits could be worth upward of $50 billion in 2030.

Voluntary carbon markets are platforms where carbon credits are bought and sold voluntarily, as opposed to being mandated by regulatory frameworks. These markets allow various entities to invest in projects that reduce or sequester greenhouse gases, providing a way to offset emissions and support environmental sustainability.

1. Voluntary Participation: Participation is driven by the desire to meet corporate social responsibility goals or achieve climate neutrality.

2. Diverse Project Types: Projects include reforestation, renewable energy, methane capture, and more.

3. Certification and Standards: Projects must adhere to recognized standards like the Verified Carbon Standard (VCS) and the Gold Standard.

1. Project Developers: These are entities that create and implement projects aimed at reducing or sequestering greenhouse gases. They are responsible for generating carbon credits and ensuring their projects meet certification standards.

2. Carbon Credit Buyers: Buyers include corporations, governments, and individuals who purchase carbon credits to offset their emissions. They seek to meet sustainability targets, enhance their environmental credentials, or fulfil voluntary commitments.

3. Certifiers and Validators: These organizations assess and verify the quality and impact of carbon projects. They ensure that projects meet established standards and that credits represent real and additional emissions reductions.

4. Brokers and Traders: Brokers facilitate transactions between buyers and sellers of carbon credits, while traders may buy and sell credits to capitalize on market opportunities. Their role is essential in providing liquidity and market access.

Carbon credit prices in voluntary markets are influenced by various factors, including project type, verification standards, and market demand. Pricing mechanisms can vary, with some credits priced based on fixed rates while others are subject to market fluctuations. Projects with high co-benefits or innovative approaches may command higher prices. Credits from projects meeting rigorous certification standards often have higher prices due to perceived quality and reliability. Supply and demand dynamics influence pricing, with higher demand potentially driving up prices.

Carbon credit prices can be volatile, reflecting changes in supply, demand, and market conditions. Emerging trends, such as increased corporate commitments to net-zero emissions, may influence pricing and market dynamics.

According to a 2020 World Bank report, carbon prices in the voluntary carbon market range from under $1 per ton of CO2e to as high as $119 per ton. Notably, nearly half of the emissions are priced at less than $10 per ton of CO2e.

Carbon markets have always come under the scrutiny for greenwashing and the purchase of high-quality carbon credit is surely a credible pathway for companies to reach net-zero through reductions and compensation of unavoidable emissions. The credits need to be VALID – Verifiable, Additional, Leakage-free, Irreversible and not Double-counted. These issues need to be addressed and the emission reductions and removals need to align to the country’s NDCs. There must be transparency in the institutional and financial infrastructure of these markets.

Scope 3 emissions are very complex and difficult to capture. Carbon accounting of supply chains needs a robust tool.

In the VCM, greenhouse gas (GHG) accounting plays a crucial role in quantifying and verifying emissions reductions. Accurate GHG accounting ensures that carbon credits represent genuine, measurable, and additional reductions. It involves calculating emissions across various sectors, validating reduction projects, and verifying results through third-party assessments. This rigorous process maintains the integrity of carbon credits and builds trust among stakeholders, ultimately supporting more effective climate action and sustainable practices.

Integrity within carbon markets encompasses a commitment to ethical and transparent practices throughout the entire lifecycle of carbon credits. At its core, integrity ensures that the emission reduction projects funded through the VCM genuinely contribute to mitigating climate change. Without this commitment, the credibility and effectiveness of the VCM could be compromised, leading to scepticism and undermining the broader goals of emission reduction.

The Integrity Council for the voluntary carbon market (ICVM) plays a pivotal role in maintaining carbon market integrity by establishing and enforcing robust standards for carbon offset projects. By promoting transparency, accountability, and rigorous verification processes, ICVM ensures that carbon credits represent genuine and verifiable emissions reductions. Their guidelines help safeguard the credibility of the carbon market, enhancing stakeholder trust and driving effective climate action. As a key player in upholding market standards, ICVM fosters a reliable and impactful carbon offset ecosystem.

1. Additionality: Carbon credits must represent emissions reductions that are additional to what would have occurred without the project. This means that the project should contribute to reductions beyond the business-as-usual scenario.

2. Real and Measurable Reductions: Credits should be based on real, measurable, and verifiable emissions reductions. Projects must demonstrate actual reductions in greenhouse gases, which are quantified and verified through monitoring and reporting.

3. Permanence: The emissions reductions achieved by a project should be permanent, meaning that they are not reversed or undone over time. For example, reforestation projects must ensure that forests remain intact and continue to sequester carbon.

4. No Double Counting: Each carbon credit must be unique and not double-counted. Blockchain technology can play a role in preventing double counting by providing a transparent and immutable record of credit issuance and transactions.

5. Transparency: The VCM must operate with transparency, providing clear information about project methodologies, verification processes, and credit issuance. This transparency helps build trust and credibility in the market.

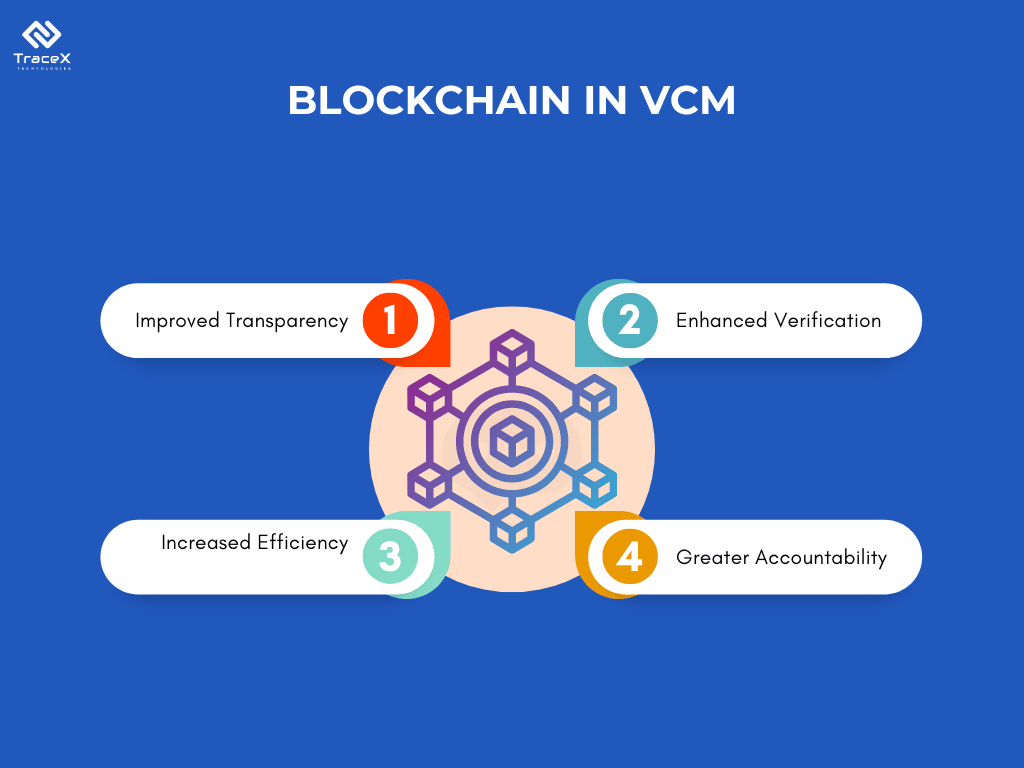

Blockchain technology has the potential to revolutionize the voluntary carbon market by enhancing transparency and traceability.

Double Counting: Each carbon credit is recorded as a transaction on the blockchain. This transaction includes detailed information about the credit’s origin, the methods used for emission reductions, and its transfer history. Because the blockchain is immutable and decentralized, all participants can trust the information on it. This solves the problem of double-counting as each credit’s unique identifier prevents it from being duplicated or sold multiple times.

Intermediaries: Blockchain’s inherent transparency will expose significant markups within the system. Furthermore, blockchain platforms facilitate direct communication between project developers and buyers. Buyers have the ability to search for credits that align with their preferences. All project details will be encoded within the credit, and sellers will not be subject to any fees.

Measuring and Reporting: Project developers have the capability to record both digital and analog measurement, reporting, and verification (MRV) data directly onto the blockchain. This streamlined process alleviates the burden on validation and verification bodies and crediting programs.

Verification Delays: Blockchain can enable real-time tracking of the verification progress for all parties involved. This transparency and visibility into the verification status can prevent delays by allowing proactive issue resolution. The transparent nature of blockchain ensures that all transaction and verification data is readily available and accessible to authorized parties.

The Voluntary Carbon Markets (VCM) plays a crucial role in global efforts to mitigate climate change by allowing businesses and individuals to offset their carbon emissions through purchasing carbon credits. However, the effectiveness and credibility of these markets hinge on robust mechanisms for monitoring, reporting, and verifying (MRV) carbon projects.

TraceX’s DMRV platform provides advanced digital tools for precise measurement and real-time reporting of carbon sequestration activities. The platform leverages blockchain technology to ensure that data on carbon credits is accurate, tamper-proof, and verifiable. This enhances the reliability of reported emissions reductions and strengthens stakeholder confidence.

By using blockchain technology, the platform ensures that all data related to carbon credits, including project activities and outcomes, is transparently recorded and accessible. This digital ledger provides a clear, immutable audit trail of all transactions and project developments, which helps in verifying the integrity of carbon credits and avoiding disputes.

The platform streamlines the verification process by integrating automated checks and real-time data analysis. This reduces the administrative burden and accelerates the certification timeline, enabling quicker issuance of carbon credits and more efficient market participation.

The DMRV platform employs blockchain to safeguard data integrity. Each data entry related to carbon projects is cryptographically secured and cannot be altered once recorded. This immutable data ensures that all emissions reductions are accurately represented and verifiable.

The scalable DMRV platform is designed to handle increasing volumes of data and transactions seamlessly. The platform’s efficient processing capabilities support the scalability of carbon projects and facilitate smooth market operations.

The platform provides real-time monitoring capabilities, allowing stakeholders to track project performance and emissions reductions as they occur. This real-time visibility ensures prompt updates and adjustments, improving overall project management.

The platform integrates data from various sources into a unified platform, simplifying data management and analysis. This integration supports comprehensive assessments and ensures all relevant information is accessible in one place.

Explore our DMRV Platform

The voluntary carbon market (VCM) is a pivotal component of global climate strategies, enabling businesses and individuals to offset their carbon footprints while supporting sustainable development projects. As the market grows, addressing challenges related to measurement, transparency, verification, and data integrity becomes increasingly crucial. TraceX’s Digital MRV (DMRV) platform emerges as a transformative solution, offering the tools and technology necessary to enhance the credibility and efficiency of carbon credits. By ensuring accurate reporting, transparent data, and streamlined processes, TraceX empowers stakeholders to navigate the voluntary carbon markets with confidence and integrity. As we continue to advance our collective efforts toward a sustainable future, leveraging such innovative solutions will be key to maximizing the impact of voluntary carbon markets and driving meaningful climate action.